Read the latest issue of the Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

Date of issue: May 13, 2020

|

|

|

|

|

|

Quick Bites – Demand Gap: Smaller Than Feared?

|

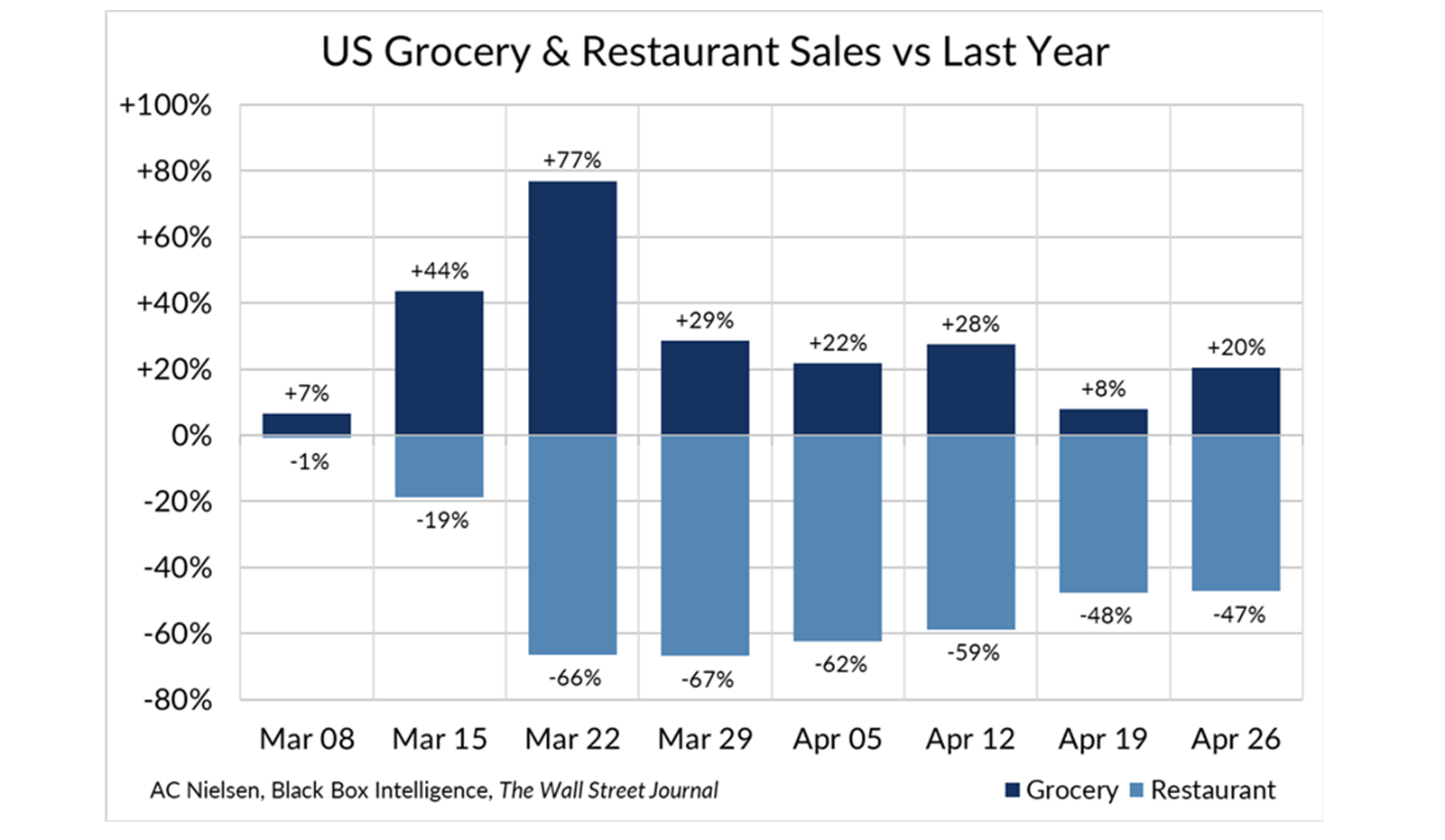

- Turns out an empty chair is not the same thing as an empty plate. In mid-March, when restaurant dining rooms closed across the U.S., foodservice providers and their dairy suppliers worried about lost sales.

- At the onset, the fear seemed justified, with Black Box Intelligence showing same store chain restaurant sales down nearly 70% in late March.

- But it didn’t last long. Restaurants quickly ramped up efforts to revive sales through delivery and takeout channels. Consumers, presumably tired of their own cooking, embraced the concept. By late April, sales losses were down to less than 50% year-over-year. And with more states lifting lockdown measures, food service demand should continue to rebound. That’s good news for dairy demand.

- Also good news for dairy demand? Strong retail sales. Retail scanner data continues to point to substantial cheese sales growth week after week with near 30% expansion in volume in April. Retail ice cream sales in April … up by more than 25%.

- Early on in this pandemic, estimates pointed to a potential 10% drop in dairy demand. In reality, the decline is likely closer to single digits given better than expected food service business, strong retail sales and government purchases.

|

|

|

|

|

-

$317 million dollars over six weeks. That’s what USDA is planning to spend on dairy products through it’s new “Food Box” aid program, running from May 15 to June 30. Last Friday’s announcement from USDA took the market by surprise as most expected awards near $100 million per month over six-months as initially outlined. USDA came out more aggressively with plans to spend more than $1.2 billion on dairy, meat and produce during the initial phase of this program that will deliver pre-packed boxes of goods to non-profits through numerous distributors.

-

Fluid is the biggest beneficiary within the dairy category, with more than $187 million (59%) allocated to bottled milk. The rest of the dollars will be used to buy cheese, butter, yogurt, and other dairy goods. How much of a difference could the buying make to the market? With details still rolling out, it’s hard to put a fine point on the volume impact. But spot and futures prices are sharply higher as producers and packagers begin to see associated order flow.

-

In addition to the “Food Box” program, USDA has money set aside through the Families First Coronavirus Response Act and Section 32 to help purchase additional products for food banks. In recent weeks USDA announced it had the authority to buy about $120 million worth of dairy products under the Section 32 umbrella for delivery starting in July.

-

Sign up for IDFA Updates at www.idfa.org to stay up to date on the latest USDA news and analysis.

|

|

|

Something Sweet: Passport Stamps in a Minute

|

|

[IDFA Video Thumbnil] [[https://dairy.wistia.com/medias/dagl2auh4h]]

|

|

|

|

|

|

|

|

|

|

|

International Dairy Foods Association

1250 H Street, NW • Suite 900

Washington, DC 20005

202.737.4332

www.idfa.org

|

|

|

|

|

|