Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

October 8, 2020: The Dairy Bar: Consumer Holiday Spending Prediction, U.S. Dairy Exports On a Roll & Boost to Sales in China Fueling U.S. Whey Exports

Quick Bites: Quick Bites: How do Consumers Spend in a Pandemic?

- Cooler temperatures typically bring anticipation of holiday fun – delicious baked goods, trips to grandma’s house and festive parties. But with persistent cases of COVID-19 weighing on the economy, employment, spending and travel, it’s likely 2020 celebrations will look different.

- Big holiday gatherings with the family will likely be muted. A majority of Americans – 65% – plan to limit their celebrations to immediate family or members of their households, according to a report by Numerator. For others, Zoom might be a new addition to the dinner table – 18% of respondents plan to take their celebrations virtual.

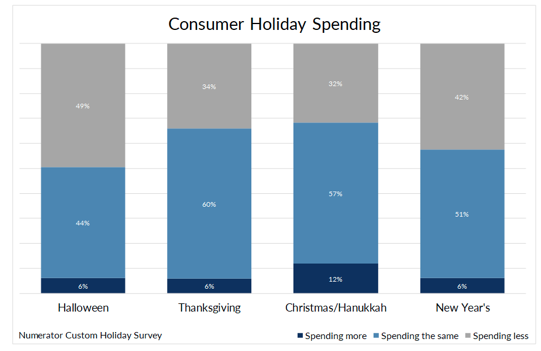

- What does that mean for holiday spending? In a study conducted by Morning Consult, 33% of respondents said they plan to spend less and save more this holiday season. That’s due in part to financial worries – 26% said they’re concerned about the current economic downturn, while 20% are nervous about their personal finances.

- Consumers also plan to shift the way they shop. E-commerce is set to shine, with 57% of survey-takers planning to make purchases online and have items delivered to their doors. For those heading to brick-and-mortar stores, 53% said they plan to avoid popular shopping times and large crowds.

- It’s too soon to tell how a shift to smaller gatherings and less out-and-about shopping impacts dairy, but a Morning Consult survey showed 64% of consumers plan to spend less on snacks, food and/or beverages this holiday season.

Today's Special

- U.S. exports are on a roll in 2020. USDA data points to an 11% bump in U.S. dairy exports on a dollar basis year-over-year in August, marking the fourteenth consecutive month of growth.

- Milk powder exports are leading the way. NDM/SMP shipments reached 153 million pounds in August, rising 35% from 2019. That took export sales year-to-date through August up to 1.22 billion pounds, a 29% increase year-over-year and accounting for 72% of NDM/SMP production so far in 2020. This uptick in volume comes despite a 15% slump in shipments to Mexico year-to-date. But expansion into Southeast Asia, the Middle East and North Africa has picked up the slack. Supported by shifting trade policy dynamics and a push to build inventory amidst COVID-19 uncertainty, U.S. sales to Southeast Asia jumped 76% year-over-year to 511 million pounds. Volume to MENA nearly tripled to reach 73 million pounds. U.S. NDM/SMP exports will likely remain on favorable footing heading into year-end with competitive values and a weak dollar encouraging buyers to keep their eyes on U.S. product.

- Cheese exports outperformed expectations in August with 68 million pounds shipped, up 17% year-over-year.That helped push year-to-date cheese exports to 558 million pounds, 3% higher on the year. Unlike NDM/SMP exports, cheese sales to Mexico have stayed positive in 2020 with outbound shipments through August reaching 152 million pounds, up 14% over 2019. There’s a similar growth story playing out in South Korea, where shipments through August reached 116 million pounds, up 15% year-over-year. U.S. cheese export opportunities may begin to face headwinds into year-end as uncompetitive and exceedingly volatile prices push importers to look elsewhere.

- A big boost in sales to China is fueling gains in U.S. whey exports this year. August shipments topped prior-year levels by 54%, taking year-to-date shipments to 303 million pounds, up 29%. Exports to date account for 46% of dry whey production in 2020 – up from 35% in 2019. China’s hog industry is the driving force behind sales growth in 2020, with shipments reaching 130 million pounds through August, up 157% year-over-year. Continued rebuilding of the country’s herds will keep the flow of exports moving through the end of 2020.

- For more information on U.S. trade and trade policy, please contact Becky Rasdall, IDFA’s VP of Trade Policy and International Affairs at BRasdall@idfa.org.