Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Blimling and Associates, Inc., a dairy research and consulting firm based in Madison, Wisconsin. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Hiring on the Rise; An Upswing in China's Dairy Consumption; Travel Spending Bouncing Back; and Ice Cream in a Minute!

Quick Bites: China's Dairy Demand

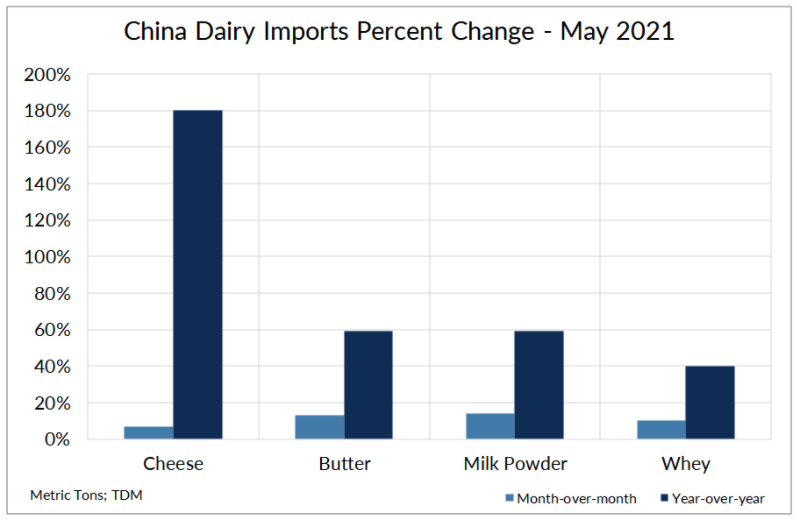

- China imports were still going strong through May. Inbound shipments of skim milk powder increased 110% year-over-year, while whole milk powder volume climbed 72% versus prior-year levels. That boosted year-to-date milk powder imports to the highest level since 2013.

- Cheese and butter imports also advanced, as China’s dairy consumption remains on the upswing. Imports of cheese rose 7% year-over-year in May, putting year-to-date inbound shipments 66% ahead of prior-year levels. Butter imports, meanwhile, increased 59% year-over-year.

- Whey imports are trending higher, up 40% year-over-year in May. But the long-term future for Chinese whey imports is unclear. Chinese officials state their hog herd has returned to 98% of the population seen prior to the 2019-2020 outbreaks of African swine fever. However, ongoing concerns about the disease have caused Chinese hog prices to plummet and hog producers to scale back piglet purchases and herd restocking. Activity from the U.S. could also be limited due to less competitive pricing on a spot basis.

- Lower birth rates, China’s goals to become more self-sufficient in infant formula production and a myriad of import regulations are hurting inbound shipments of infant formula. Through May, year-to-date imports fell 20% from the same period in 2020. While Chinese efforts to curb declining birth rates through new policies could stir up some additional consumption, thus far these policies have done little to encourage additional births. Import demand for infant formula is likely to continue to struggle under the weight of the regulatory barriers and market demands.

Today's Special

- Hiring continues to pick up steam. U.S. employers added 850,000 workers in June, up from +583,000 in May and above expectations for +703,000. But payrolls are still down by 6.7 million workers from February 2020. The unemployment rate also rose slightly to 5.9% last month, up from 5.8% in May and above forecasts for 5.6%.

- Personal income, meanwhile, remained flat month-over-month and declined 2.0% year-over-year. Still, at $20.8 trillion on a seasonally adjusted annualized basis, total earnings remain well above 2019 levels.

- Increased demand, elevated commodity prices and logistics snarls mean buyers are paying more. The S&P CoreLogic Case-Shiller Index, which measures home prices in 20 major U.S. cities rose, in April at the fastest pace in 15 years. Analysts say the housing supply isn’t keeping pace with demand, especially as supply chain bottlenecks limit construction and remodeling activity. Meanwhile, prices for materials like lumber and steel remain well over 2019 levels, adding to home costs.

- Consumers are also upping their travel spending as restrictions roll back across the country. During the week ending June 26, hotel occupancy reached 70%, up from 46% last year. Air travel rose to 14.2 million people during the seven days ending July 2, a 222% increase over prior-year levels. And even more Americans were expected to hit the road and airways for Fourth of July celebrations. AAA estimated at least 47 million people would travel from July 1-5.

- But overall retail sales lagged in May, declining 1.3% from April on fewer purchases of building materials, gardening equipment, electronics and furniture. Still, sales remain up 28.1% year-over-year, especially as food service activity regains momentum.