Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: China Economy Remains Sluggish; Pressure on Producers; and Consumer Spending in a Minute!

Quick Bites: Producers Under Pressure

- On-farm margins are feeling the pinch of higher feed costs and lower milk prices. And the strain is leading some dairy producers to exit the industry.

- Tighter stocks, healthy export interest and uncertainty around the Black Sea trade deal sent corn and soybean prices – and, in turn, feed costs – higher during the first part of the year. Dairy Margin Coverage estimates by Ever.Ag suggest dairy producers paid nearly $15 per hundredweight for feed during the first half of 2023. Though grain markets have since eased, concerns about dry conditions are keeping prices elevated and could keep feed costs supported in the second half.

- Meanwhile, ample milk supplies are dragging on the national “all milk” price, which averaged just under $21 per hundredweight during the first half. That compares to a midpoint near $25 during the second half of 2022.

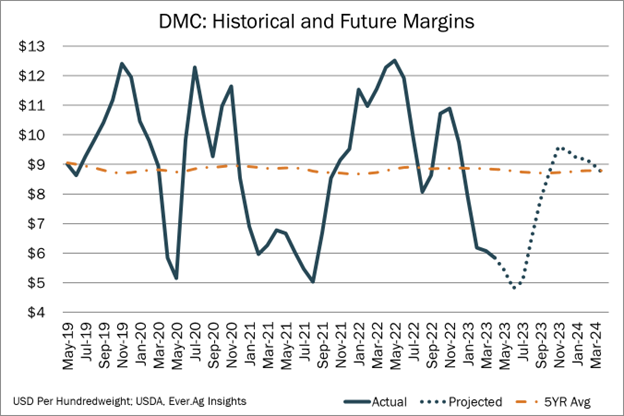

- As a result, many producers’ milk checks are well below production costs. DMC margins for May through July currently pencil at $5.10 per hundredweight. That would be the worst three-month stretch since 2009. Things turn higher from there, but spot markets will have to firm considerably in the months ahead to make that happen.

Today's Special

- Despite the rollback of Covid-era restrictions, China’s economic activity remains sluggish. The National Bureau of Statistics reported industrial output climbed 3.5% year-over-year in May, just below expectations and well below April’s gain of 5.6%. Another gauge of economic health – retail sales – increased 12.7% on the year in May, lagging consensus calls for +13.6% and down from +18.4% the month prior.

- The country’s job market is also showing signs of strain – particularly among youth. The unemployment rate among ages 16 to 24 reached 20.8% in May, a new all-time high. In comparison, the jobless rate in cities among all ages was 5.2%. That number could balloon further this summer, when an estimated 11.6 million college students are expected to enter the job market.

- A study of China’s commodity markets also points to a shaky economy. China makes up roughly half of the world’s plate glass production due to robust property and vehicle demand. But recent pullbacks in home and vehicle purchases are creating supply gluts and weighing on glass futures at the Zhengzhou Commodity Exchange. Similarly, prices for commodities like styrene (a material used in plastics and rubber) and corn starch are under pressure as consumers pull back on spending.

- To stimulate economic activity, the People’s Bank of China announced in mid-June a cut to its medium-term lending rate, the second such decrease in a week. Previously, the rate hadn’t changed since August 2022.

- On the heels of disappointing data, analysts are lowering forecasts for China’s economic growth. Nomura lowered expectations for 2023 and 2024 GDP growth to 5.5% and 4.2%, respectively. The country’s government officials expect a slightly more modest increase this year, at 5%.