Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Americans Beat the Heat With Ice Cream; Dairy Export Competition Heating Up; and Independence Day Spending in a Minute!

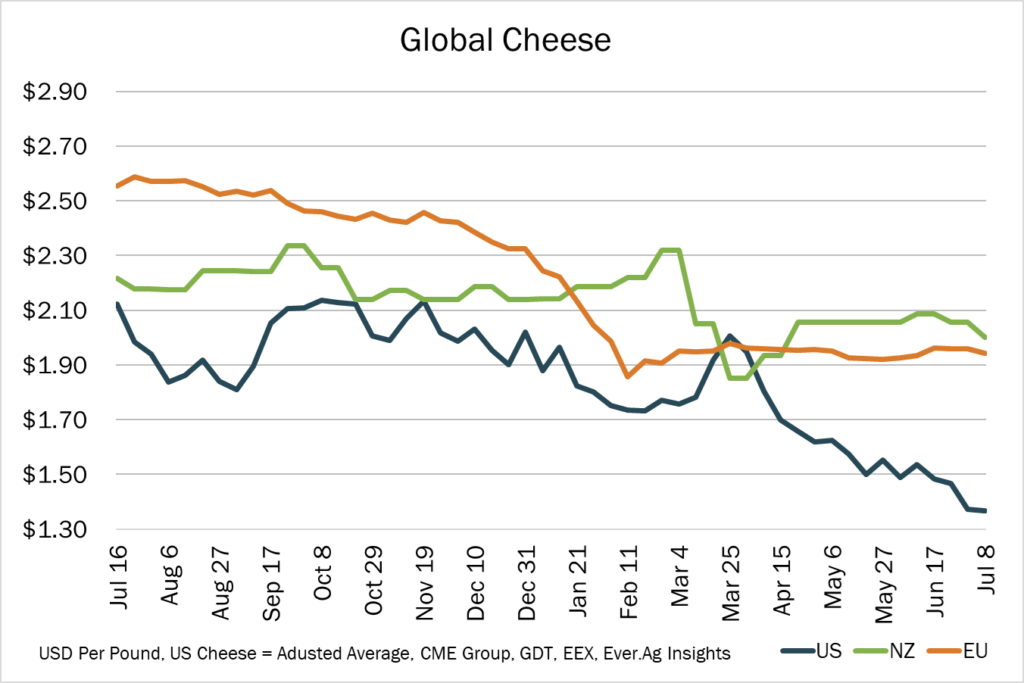

Quick Bites: Export Competition Heating Up

- Uncompetitive pricing dented U.S. dairy export prospects earlier this year. But recently lower spot cheese, milk powder and whey prices could help drum up demand in the coming months.

- U.S. cheese prices hovered near $1.90 per pound during the first quarter, holding a significant premium to EU mozzarella, which averaged roughly $1.50. Data shows U.S. product lost volume, with total cheese exports year-to-date through May dipping 4% versus 2022 levels. Recent declines at the CME could turn the tide, though, with spot cheese now pricing near $1.40 per pound, below EU mozzarella, which recently pressed as high as $1.72. However, fourth quarter cheese futures still hold a premium to spot values and could deter global buyers.

- Combined nonfat dry milk and skim milk powder exports also softened during the first five months of the year, declining 1% versus 2022. But drops in the spot nonfat dry milk market over the last few weeks brought U.S. pricing in line with New Zealand and below EU prices, possibly attracting some export business. Similarly, whey sales through May dipped 2% on the year, but new record lows in spot whey put the U.S. well below global competitors.

- But U.S. butter is unlikely to win export bids anytime soon, as spot prices continue to trade between $2.30 and $2.50 per pound, well above EU and New Zealand values. Amid uncompetitive pricing, outbound butter shipments fell 30% year-over-year during the first five months of 2023.

Today's Special

- Summer temperatures continue to spike in various areas, as they do, and Americans are cooling off with their favorite frozen treats during National Ice Cream Month. The average American consumes about 20 pounds or roughly four gallons of ice cream each year, according to the U.S. Census Bureau. Their favorite flavors? Chocolate, cookies n’ cream and vanilla, according to IDFA's National Ice Cream Trends survey.

- To keep up with that demand, the U.S. uses approximately 9% of its total milk supply on ice cream production each year. In 2022, American ice cream makers produced about 1.38 billion gallons of ice cream (about 6.45 billion pounds), including roughly 727 million pounds of regular hard and 446 million pounds of low-fat ice cream. Output has slowed this year, with production year-to-date through May at 302 million pounds of regular hard and 179 million pounds of low-fat ice cream.

- Ice cream has a roughly $11.4 billion impact on the U.S. economy, according to IDFA data. The industry employs 27,100 workers and generates about $1.9 billion in wages.

- Fortune Business Insights reported the global ice cream market totaled $73.61 billion USD in 2022. And it’s not done growing. Worldwide, ice cream is expected to expand to a $104.96 billion USD industry by 2029 as demand grows in every region.