Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Cheese Stocks Down Despite Production Rise; Middle East Upheaval Yet to Roil Gas Prices; and China Imports Update in a Minute!

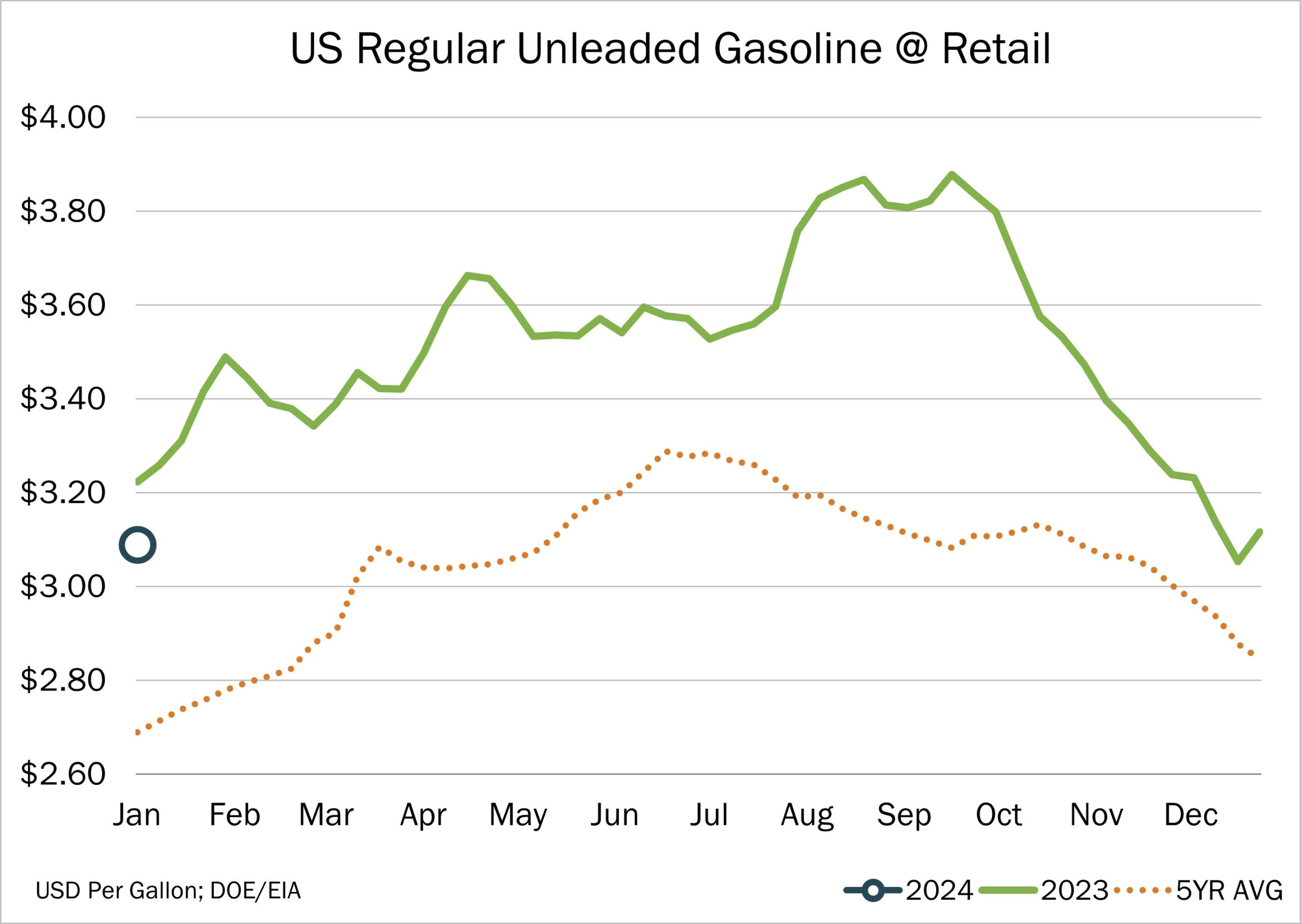

Quick Bites: Gas Prices Calm Despite Middle East Upheaval

- Turmoil in the Middle East has dominated headlines recently. First there was the war in Gaza. Then Houthi rebel attacks in the Red Sea threatened major disruptions to shipping routes. At the same time, OPEC+ announced its decision to cut oil production by an additional million barrels per day. With so much upheaval in the region, many predicted crude oil and gasoline prices would skyrocket.

- But, so far, that hasn’t been the case. WTI crude oil finished December down more than 10% year-over-year, the first annual decline since 2020. And while ongoing tensions in the Red Sea have markets a bit jittery, we still haven’t seen any major price jumps.

- Why? In large part, that’s due to high production in other parts of the world, particularly the U.S. Analysts predict global demand will drop in 2024 and non-OPEC output should more than meet the world’s needs. That’s particularly true when it comes to China, where demand is dropping sharply.

- At home, lower energy prices have contributed significantly to cooling inflation. The continuation of that trend should strengthen consumer confidence in the months ahead.

Today's Special

- We make a lot of cheese in the United States, even when milk production is on the soft side. That was definitely the case in November, with total output at 1.16 billion pounds, up 0.7% year-over-year in a month that saw milk production down 0.6% versus year-prior levels. American-type and Italian-type cheese participated equally in the acceleration, with both up 0.7% when compared to November 2022.

- Despite growing output, cheese stocks declined by a greater-than-average amount between October and November. The USDA Cold Storage report showed inventories at 1.434 billion pounds, down 25 million pounds from October compared to -16 million on average over the previous five years. The total on hand was barely above year-prior levels: +0.2% compared to +0.7% in October.

- Class IV products bore the brunt of reduced farm milk supply, especially powder. Butter production added up to 165 million pounds, down 3.7% year-over-year. Meanwhile, combined nonfat dry milk and skim milk powder production totaled only 174 million pounds, down 17.3% from November 2022 levels.

- Against that backdrop it wasn’t surprising to see manufacturers holding lighter powder inventories: 209 million pounds, down 3.6% from October and down 16.9% year-over-year to the lowest total for November since 2015.

- Butter stocks didn’t suffer as much, hinting at slowing demand, presumably a function of record high wholesale prices. USDA reported November 30 inventories at 215 million pounds, down 25 million from October – well below the five-year average draw of 57 million pounds between the two months. The total on hand was up 7.8% year-over-year, the biggest margin since May.