Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Dairy Herd Inventory Down; Super Bowl Food Prep Spells Boon for Dairy; and Butter in a Minute!

Quick Bites: Dairy Touchdown?

- It’s almost time for the Super Bowl, a burst of excitement in the dead of winter. The National Retail Federation predicts a record 200.5 million adults will watch the action on February 11. And as the 49ers and Chiefs head to Las Vegas for the big game, fans at home are focusing not on who will win or how many times the cameras will cut to Taylor Swift, but on the food.

- More than 112 million people plan to throw or attend a party and 16 million will spend the evening at a bar or restaurant. A whopping 80% of those consumers plan to purchase food and drinks, a potential boon for the dairy industry. After all, traditional Super Bowl foods tend to be heavy on sour cream, butter and cheeses for the assortment of pizzas, dips and other snacks fans scarf down during the game. It’s clearly a big day for pizza, with some estimates putting consumption at 12.5 million pies.

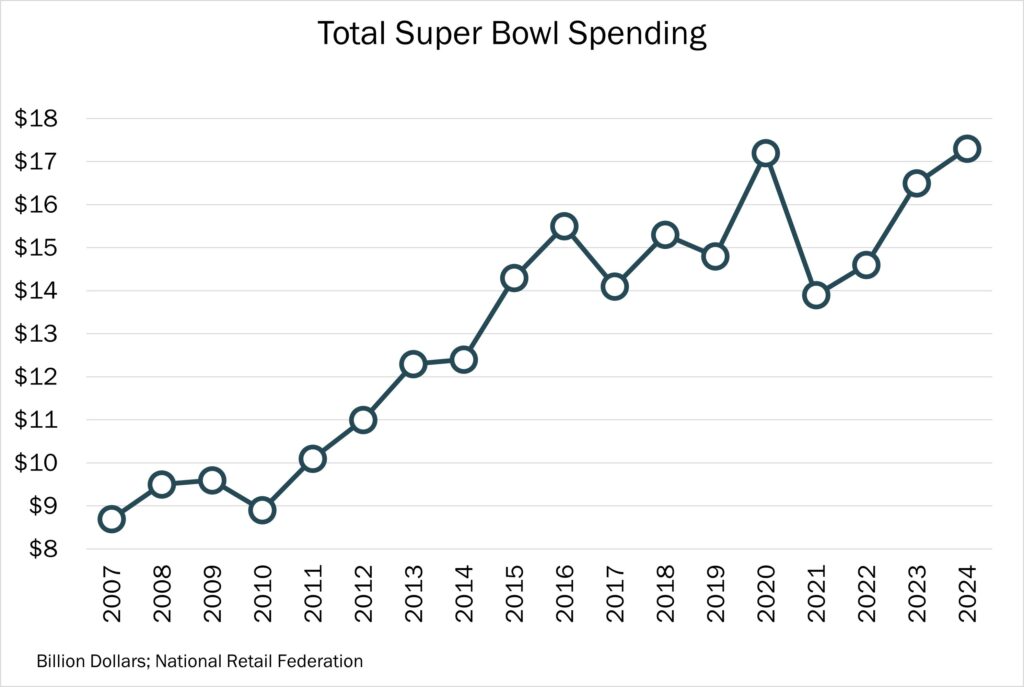

- According to NRF’s data, Americans plan to spend an average of $86.04 per person on game-day festivities, for a grand total of $17.3 billion, topping the previous record-high set in 2020. We’ll have to wait and see how much of that money flows into dairy, but it could be a big win.

Today's Special

- How hard will be it be for the U.S. dairy herd to grow in the future? In its year-end Cattle report, USDA reported 2024 heifer inventory down 0.4% year-over-year, on top of a 0.5% reduction to 2023 data. That took heifer inventory to the lowest point since 1998. And it’s unlikely much growth is ahead. The number of heifers to calve fell 1.0% on the year to a level last seen in 2004.

- Over the past year or so, high beef prices and so-so dairy margins encouraged producers to cull additional cattle. Taking a longer view, the increasing popularity of “beef on dairy” programs has cut into dairy heifer supplies. Producers deploying beef on dairy are breeding dairy cows with beef semen. So rather than moving into dairy replacement channels, calves move into beef operations. This creates immediate cash flow for dairy producers while also cutting time and risk associated with raising dairy replacements.

- Still, producers in some parts of the country are planning expansions. For example, a major dairy in South Dakota – where operating costs are lower – expects to add tens of thousands of cows in 2025 and 2026, per a report by Dairy Herd Management. Lower operating costs could also augur growth in the months ahead. Estimates under USDA’s Dairy Margin Coverage program peg 2024 feed costs around $11 per hundredweight, down from nearly $14 last year. That could help on-farm margins top $10 per hundredweight, compared to less than $7 in 2023.

- It will take more cows and milk to support additional cheese output over the next few years. More than $7 billion in dairy processing capacity is currently planned, including at least 10 cheese plants, per research by IDFA. And further growth is likely, with 73% of dairy processing executives planning to increase their investments in the next three to five years, according to a survey by McKinsey.