Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Analysts Expect Restaurant Sales Record, More Consumers Dining at Home Amid Inflation, and U.S. Dairy Trade in a Minute!

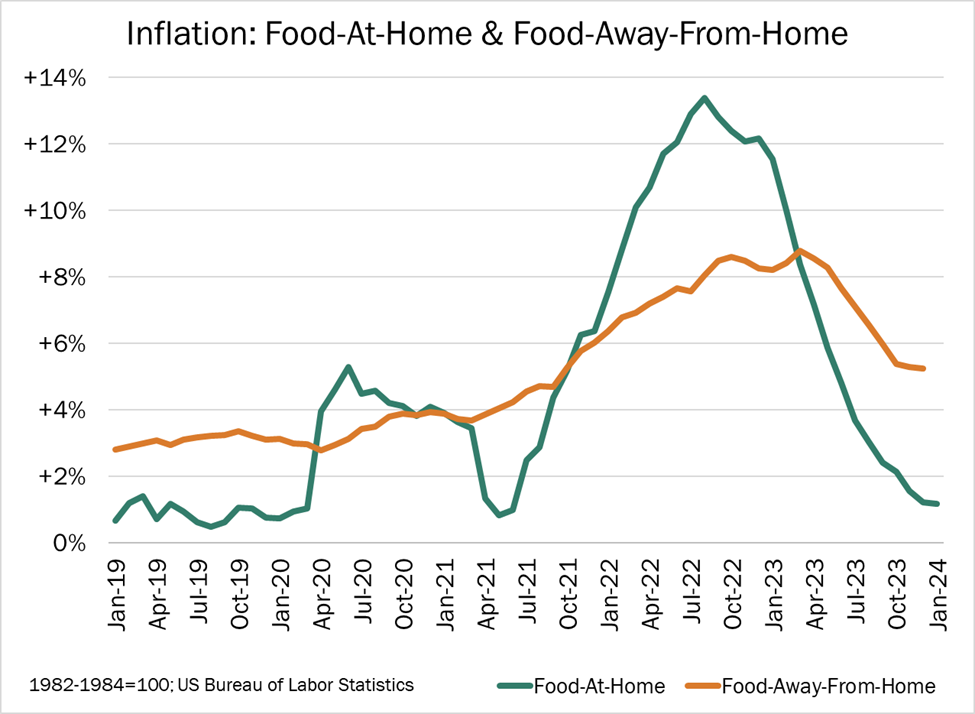

Quick Bites: The Growing Price Gap

- Last year, Darden CEO Rick Cardenas dubbed dining out an “affordable luxury” for many Americans. But with food-away-from-home inflation still running hot, more consumers may be staying home.

- Higher prices beleaguered restaurant chains – including cheese-friendly concepts – last year. Yum! Brands, parent company of KFC, Taco Bell and Pizza Hut, reported a dip in fourth quarter revenue to $2.04 billion. Similarly, Q4 sales at McDonald’s declined to $6.41 billion. Same-store sales growth generally trailed menu price inflation, suggesting deteriorating traffic and volume. In an earnings call, McDonald’s leadership pointed to a slowdown in sales among low-income customers, a sign that higher prices are discouraging some diners. And more consumers may skip drive-thrus and counter service in the months ahead. In January, menu prices increased 0.5% on the month, the fastest pace since May 2023, and increased 5.1% year-over-year. That’s off the recent highs, but still aggressive.

- Food-at-home prices are also rising – but at a slower pace. In January, grocery prices climbed 0.4% on the month and +1.2% year-over-year. It was even easier to pick up dairy, with prices up just 0.2% versus December and down 1.3% on the year. And retailers are hoping to continue picking up customers, with many pushing more butter, cheese and butter advertisements.

- Is any relief ahead? The answer is unclear. A forecast by USDA suggests grocery prices could end 2024 with a small 0.4% dip. But restaurant meals are likely to stay expensive, ending the year up 4.7%.

Today's Special

- Analysts expect restaurant sales to hit a new record this year. In its 2024 State of the Restaurant Industry Report, the National Restaurant Association forecasted spending at $1.1 trillion, the highest in history. Sales are also expected to top 2023 levels, which the Association estimated at $997 billion.

- That’s good news for restaurant operators, with most expecting robust sales. About one-third (33%) predict an uptick, while another 45% project sales will be on par with 2023. Margins will remain a struggle, however. Average food costs have climbed more than 20%, while average wages are up more than 30% since 2019, per the Association. As a result, only 27% of operators expect to turn a profit this year.

- Despite those struggles, industry employment is expected to rise. Nearly half of operators – 45% – say they need more employees to meet customer demand. And most – 70% – report they have job openings that are hard to fill.

- With inflation and other financial worries top of mind, restaurants are pushing convenience to lure in customers. Fifty-two percent of U.S. consumers say ordering takeout is essential to their lifestyle. As a result, delivery, carry-out and drive-thru options are expected to grow, the Associated reported.

- Still, challenges will remain amid high menu prices. In January, food-away-from-home inflation climbed 5.1% on the year. That’s a slowdown from previous months, but well above the pre-pandemic pace. Fortunately, consumers are still finding places in their budgets to dine out, with spending at restaurants and bars last month up 6.3% year-over-year.