Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Job Market Stronger Than Anticipated, Consumers Grapple With Higher Restaurant Prices, and U.S. Cheese in a Minute!

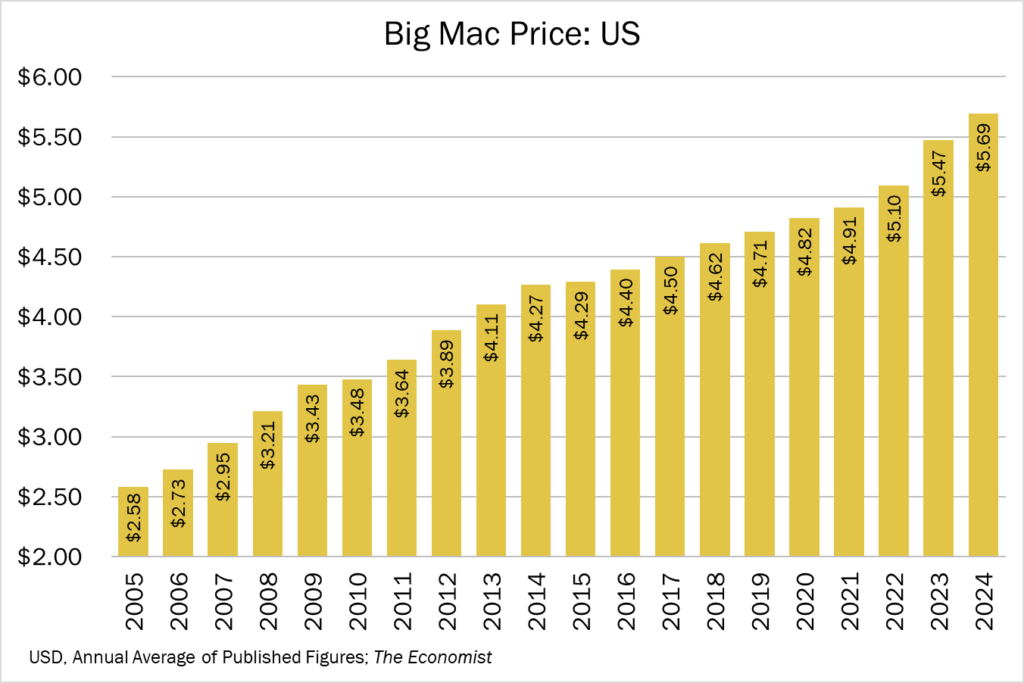

Quick Bites: Super Size Me?

- Consumers are still grappling with runaway food prices – especially at their favorite fast-food chains. Prices at fast-food eateries are up 5.2% over last year, while sit-down restaurants saw a 3.8% rise in price. A Big Mac now costs an average of $5.69 in the U.S., up 4% from 2023 and a staggering +21% from pre-pandemic levels.

- In an effort to not lose touch with customers, especially from lower income households, McDonalds is also looking to promote meal bundles at a $4 price point, with popular cheese-ladened options like the double cheeseburger to grace the menu. Wendy’s 4 for $4 program has been extremely successful.

- At the same time, grocery prices are up just 1% year-over-year, way down from the pace over the past two years. That’s likely to encourage consumers to browse their local aisles. Consumers paid less for dairy in February as prices dipped 0.6% and -1.8% year over year. To capture more shoppers, retailers last month also pushed more cheese and butter advertisements, with an average of 14,937 stores running promotions for butter, up 251% year-over-year, and an average of 10,922 stores running ads for shredded cheese, up 7% on the year.

Today's Special

- Employers continue to hire. Payrolls expanded by 275,000 positions in February, ahead of expectations for 190,000. The unemployment rate ticked up to 3.9%, up from 3.7% the month prior and ahead of forecasts for 3.7%. Still, that was relatively low when compared to a pandemic peak of 14.8% and an average of 5.4% in 2021.

- There are also plenty of jobs still available, with the number of openings reaching 8.86 million in January. That exceeded the number of unemployed people by 2.04 million. Said another way, there are an estimated 1.37 job openings for every unemployed American.

- Wages, however, didn’t climb as aggressively. Pay climbed just 0.1% between January and February, the smallest monthly increase since June 2020, and +4.3% versus 2023, the smallest yearly gain since June 2021. Since 2019, hourly earnings have risen 25%.

- Meanwhile, Americans are still feeling the pinch of higher prices. Inflation in February climbed 0.4% month-over-month and +3.2% on the year. That was just ahead of expectations for a gain of 3.1%. Food is expensive, with prices up 2.2% year-over-year last month. That included a 1.0% increase in grocery inflation and a 4.5% bump in menu prices. Since 2019, food prices have climbed 28%, outpacing growth seen in hourly earnings.

- As inflation outpaces earnings, more consumers are relying on credit cards. Revolving credit grew by $8.4 billion between December and January, compared to a 10-year average of $2.2 billion. And the amount outstanding - $1.3 trillion – increased 8.5% on the year to a record high.

- When they’re not putting it on plastic, consumers are pulling back on spending. February retail sales climbed 0.6% from January, behind consensus calls for +0.7%, and rose 1.9% on the year. Grocery store purchases eased 0.1% month-over-month, while food service sales rose just 0.4%. The impact on dairy sales isn’t certain, but stores continue to woo consumers with advertisements for cheese and butter.