Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Stronger Peso Could Bode Well For U.S. Ag; Ongoing Conflicts Put Pressure on Crude Oil Prices; and Inflation in a Minute!

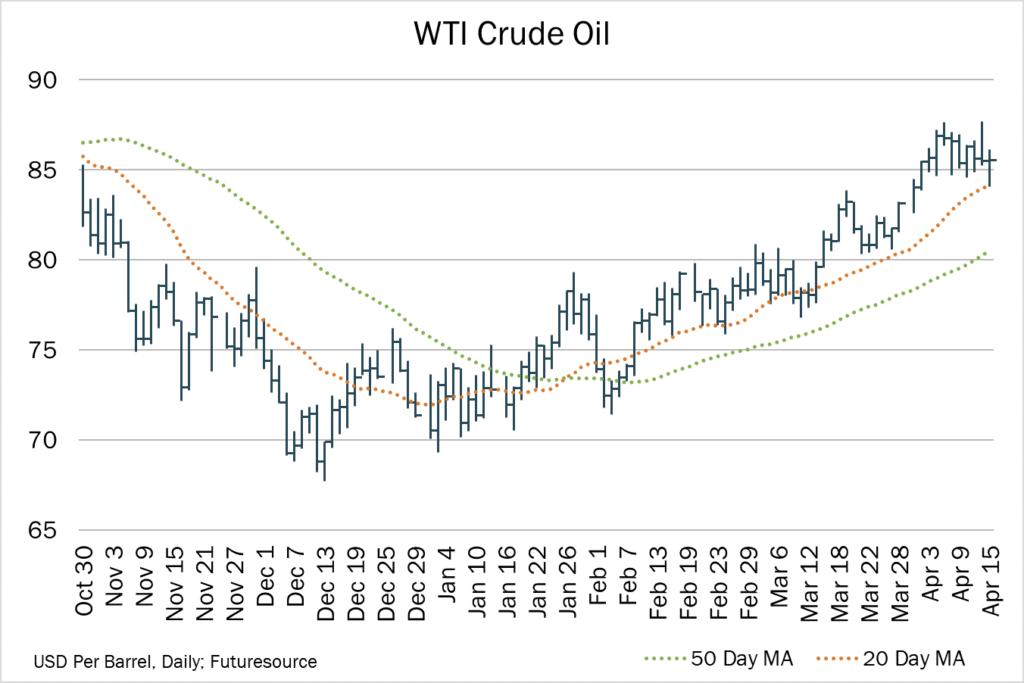

Quick Bites: Oil Rising

- Conflict in the Black Sea and Middle East regions, coupled with better consumer fuel demand, is putting upward pressure on crude oil. Brent topped $90 per barrel this month for the first time since October, while WTI futures are well above $80. Those prices are already trickling down to the pump, with unleaded gasoline reaching $3.59 per gallon during the week ending April 13, a level last seen in mid-October. Diesel also climbed to $4.06 per gallon, a two-month high.

- That could increase costs to move dairy across the country. According to Ever.Ag analysis, for every $1 increase in diesel prices, the cost to move a 50,000-pound load of milk from farm to plant rises by $17. For perspective, current diesel prices are averaging roughly 48 cents higher than the five-year average, equating to a nearly $8.50 increase per load. While Ever.Ag’s freight team says fuel surcharges aren’t climbing just yet, they could if crude stays high.

- Meanwhile, consumers paying more for fuel could cut back on spending in other areas. Food prices continue to rise, up 2.4% year-over-year in March. Dairy prices, however, were a welcome bright spot, declining 1.9% on the year.

Today's Special

- The Mexican Peso continues to strengthen against the U.S. Dollar, rising 3% year-to-date and 10% year-over-year versus 2023. Mexico’s proximity to U.S. markets has made it appealing to foreign investors. That influx to the economy, coupled with Mexico’s financial discipline, has led to appreciation of the country’s currency. The stability of the Peso also positions Mexico as a strong buyer of U.S. agriculture goods.

- Mexican consumers have a growing appetite for U.S. dairy products. In 2023, Mexico accounted for 50% of U.S. cheese exports and 30% of U.S. NDM exports. As NDM supplies have tightened and prices have risen, exports to Mexico have backed off, but cheese exports remain as strong as ever. In fact, the U.S. exported 37 million pounds of cheese to Mexico in February, up 66% on the year and the highest volume for the month on record.

- Corn exports to Mexico will also likely reach record volumes in 2024. Corn exports to Mexico will also likely reach record volumes in 2024. Much of Mexico is in severe drought, devastating corn production and leaving the country to import feed grains for livestock. With less demand coming from China, the Mexican market is proving to be a substantial outlet for U.S. agriculture commodities.

- Both the U.S. and Mexico will hold elections in 2024, which could bring changes to the USMCA in 2026. Mexico's presidential candidate front-runner, Claudia Sheinbaum, is a supporter of USMCA as it is, but plans to uphold current president Obrador's plan to ban GMO corn imports by 2024. Her opponent, Xóchitl Gálvez, wants to incentivize nearshoring and has also alluded to strengthening Mexico's relationship with the U.S.