Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

U.S. Business Activity Dips in April; GLP-1 Weight Loss Drugs Cut Into Consumer Spending; and Cheese in a Minute!

Quick Bites: The Skinny on Food and GLP-1s

- Increasingly popular weight loss and diabetes drugs – known as GLP-1s – aren’t just trimming Americans’ waistbands. They’re cutting into food spending, too. A survey by Morgan Stanley showed 31% of those taking medicines like Ozempic are spending less on groceries. When it comes to eating out, 61% have cut back on take-out and delivery, while 63% are dining at restaurants less. Under that umbrella, another survey by the firm found 74% have cut back on dining at pizza restaurants, while 77% are eating less fast food.

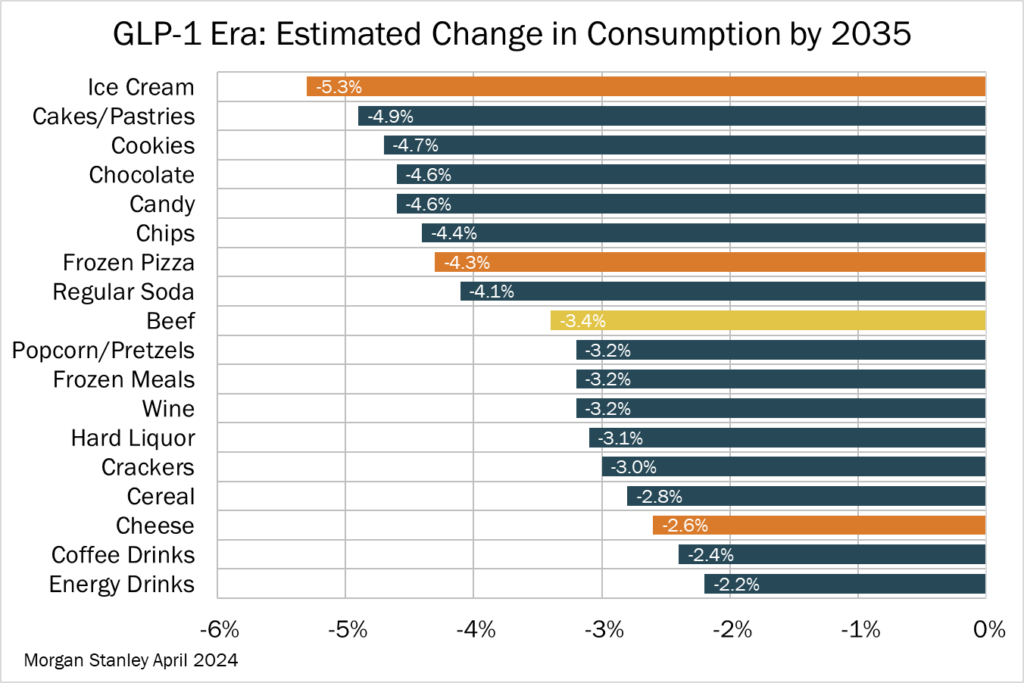

- Survey respondents also noted significant cutbacks in certain types of foods – including dairy. That’s likely to impact overall food consumption in the years ahead, per Morgan Stanley’s analysis. By 2035, ice cream consumption is expected to decrease by 5.3%, while cheese usage is set to drop 2.6%. Consumption is also likely to decrease in dairy-adjacent categories, including cakes/pastries (-4.9%), cookies (-4.7%), chocolate (-4.6%), frozen pizza (-4.3%) and cereal (-2.8%).

- The drugs are presenting opportunities for some food companies. According to Morgan Stanley, among those taking GLP-1s, 54% are buying more fruits and vegetables, while 38% are purchasing more poultry and fish. Dairy might see some benefits, too – 15% of GLP-1 users say they’re consuming more dairy products, while 57% say their consumption is the same. Yogurt, in particular, is a popular choice.

Today's Special

- U.S. business activity slowed in April. According to Bloomberg, economic activity declined going into the second quarter, with the S&P Global Flash U.S. PMI Composite Output Index, which measures output from manufacturers and service providers, slipping 1.2 points to 50.9 for the month.

- Consumer sentiment is also weakening amid economic uncertainty. With presidential election tension heightening and the Federal Reserve keeping interest rates steady, consumer sentiment dipped to 77.2 by the end of April, down from 77.9 at the beginning of the month and 79.4 in March. According to the University of Michigan, “consumers continue to express uncertainty about the future trajectory of the economy pending the outcomes of the upcoming election.”

- Inflation continues to weigh heavily on consumers, eating into their paychecks and dictating their spending. The personal savings rate, the difference between an individual’s income and spending, came in at 3.2% in March, the lowest since October 2022. Inflation is also causing more and more Americans to rely on credit cards, with total credit card spending per household up 0.3% year-over-year in March.

- Prices for goods and services continued to rise in March. Personal consumer expenditures rose 0.3%, while the price for services rose 0.4% and the price for goods elevated 0.1%. Energy prices saw a bump as well, rising 1.2%. Food prices, however, dipped slightly on the month, down less than 1%.