Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

U.S. Fast Food Chains Look To Expand Abroad; Online Grocery Sales Continue to Rise; and Restaurant Sales in a Minute!

Quick Bites: Browsing Digital Aisles

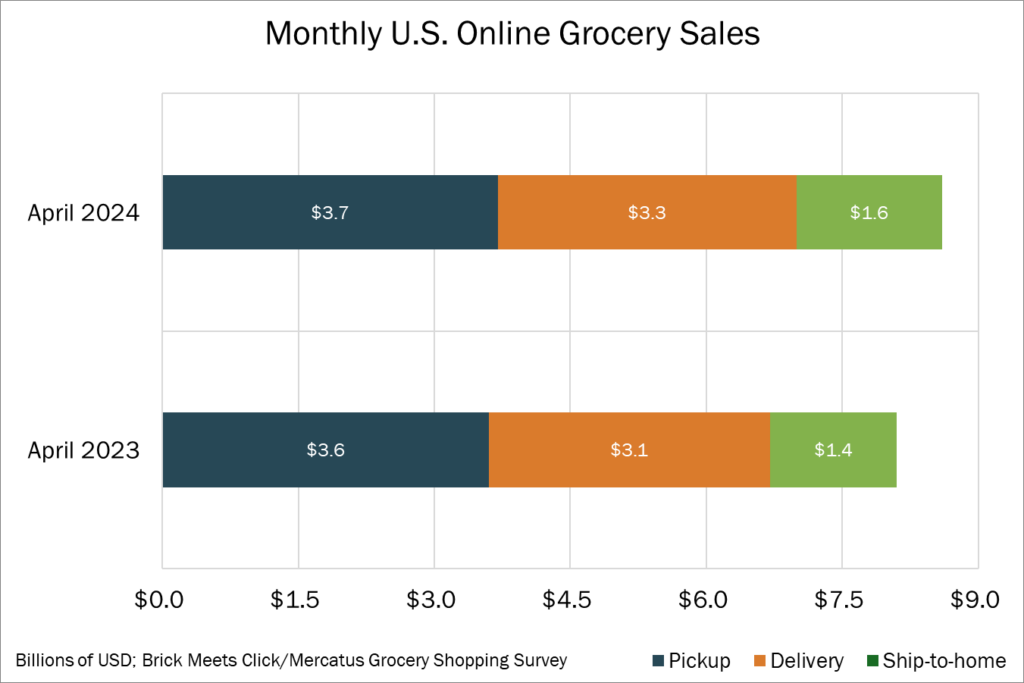

- Online grocery store shopping exploded during the pandemic. Now, online sales are expected to account for 13.7% of the U.S.’ annual $1.6 trillion in grocery sales. And by 2025, digital grocery sales are expected to total over $253 billion in the U.S. alone, gaining more than 2% share.

- With 90% of the U.S. population living within 10 miles of a Walmart, it is no surprise the grocery mogul is a leading player in online grocery sales. Other notable players in the space include Amazon, Instacart and Kroger.

- While it was initially thought the rise of digital grocery sales would harm brick-and-mortar stores, data is now showing the contrary. More consumers are opting to browse store aisles, touching and seeing food items in person, before going home and ordering them online. But online shopping trends do cut down on impulse buys.

- Retailers have found it expensive and difficult to maintain customers without a physical storefront. Ordering online for in-store pick up has become an increasingly popular approach to digital grocery shopping. In fact, 34.2% of online grocery shoppers will pick up products from brick-and-mortar stores this year, up from 33.4% in 2023.

Today's Special

- Facing inflation-strapped customers and wage pressures at home, U.S. fast food chains are looking to other markets for growth. China, with a quick-service industry that reached $176.3 billion in revenue last year, is a prime target.

- There’s plenty of room for burger concepts to expand, according to analysis by Euromonitor International. Estimates suggest China is the fifth-largest global market by sales for fast-food burgers, outpacing the U.S., Canada, France and Germany. That market is expected to grow roughly 6% per year, even as burger QSR concepts make up just 5% of China’s total fast-food market.

- That’s encouraging McDonald’s to double down on its growth in the country. Last month, the burger giant announced plans to expand its footprint in the country to more than 10,000 restaurants by 2028. Recently, the company also spent $1.8 billion to buy back business from Chinese franchisees.

- Yum China, a spinoff of U.S.-based Yum Brands, also boasts thousands of units across China and has an appetite for more. In its first quarter earnings, the company reported 378 new store openings, bringing its footprint to more than 15,000 units. Another 5,000 restaurants are expected to come online by 2026, including 1,500-1,700 this year. Yum Brands, headquartered in Louisville, Kentucky, receives a portion of Yum China’s sales.

- Despite facing significant competition from Chinese companies, Starbucks plans to capture more of the country’s coffee-drinking market. As of the end of Q1, Starbucks operated 6,975 stores in China, behind competitor Luckin Coffee, with a footprint of more than 16,000 units. The Seattle-based chain plans to reach 9,000 stores by 2025 and is working to attract more customers with unique offerings like pork-flavored lattes and mousse expressos.