Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Private Label Sales Rise; Shipping Issues Persist Amid Middle East Conflict; and Travel Trends in a Minute!

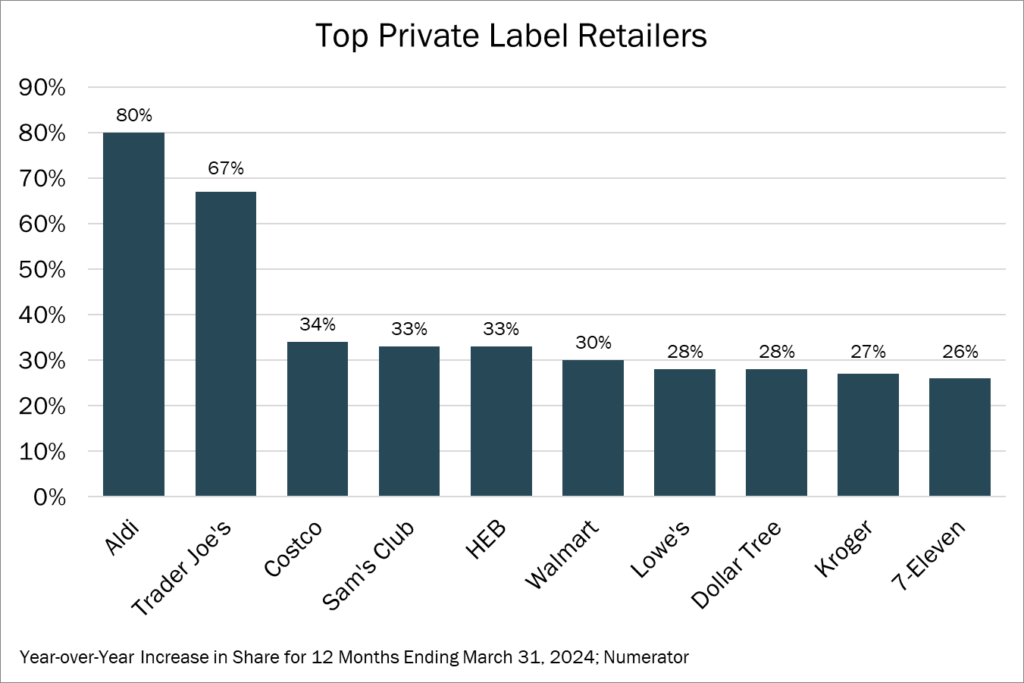

Quick Bites: Private Label Gaining Share

- Facing higher prices at grocery stores, U.S. consumers are finding relief with private-label goods. Per reports by The Wall Street Journal, purchases of lower-cost store brands comprised 22 cents of every dollar spent at grocery stores in 2023. TreeHouse Foods, a top manufacturer of private-label products, also found store brands took over 21.8% market share of consumer-packaged goods last year, up from 18.4% in 2016.

- Shoppers are trading down in dairy and adjacent categories. During the 52 weeks between May 2023 and May 2024, sales of store-brand butter, oils and margarine spreads increased 4.5%, while purchases of national brands decreased 2.2%. Purchases of private label cereal and granola rose 2.7%, while sales of cookies and crackers climbed nearly 1.0%.

- That’s encouraging many big-box retailers to invest in private label offerings. Kroger announced plans to launch more than 800 new store-brand products in 2024. Walmart also recently launched Bettergoods, a line that offers an array of plant-based and “made without” products ranging from $2 to $15.

Today's Special

- Ongoing conflict in the Middle East is encouraging ocean shippers to circumvent the Red Sea corridor, extending sail times and tightening container capacity. Avoiding the Suez Canal in favor of navigating around the Cape of Good Hope protects merchant vessels from attacks – according to Bloomberg, some 65 have been targeted since mid-November. However, the route takes 7-10 additional days to traverse.

- As a result, reliability is dropping and rates are pressing higher. As of March 1, less than 55% of vessels arrived on schedule, compared to nearly 78% during the peak of COVID-19 disruptions. Given the uncertainty, and with fewer containers on hand, rates are climbing to multi-month highs. As of May 16, costs to move goods from China to the U.S. West Coast reached $4,642 per 40-foot equivalent unit, up from $1,336 the year before, per data by Xeneta. Rates between China and Europe also climbed to $4,515 per FEU, compared to $1,374 during the same period last year.

- It's unlikely much relief is ahead – at least in the short term. Ceasefire negotiations are ongoing. Once an agreement is reached, analysts say it could take another 6-12 months for shipping traffic to rebound to normal levels.

- Meanwhile, U.S. shippers are still grappling with impacts from the Baltimore bridge collapse. Remnants of the Dali container ship were removed last week, but about half of the debris from the accident still needs to be cleared. Port of Baltimore authorities say the gateway should be open to most vessel traffic soon, though an exact timeline has not been announced. Questions also remain around the rebuilding of the Francis Scott Key Bridge.