Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Future Grocery Consumer Behavior Studies; Most Middle-Class Consumers Struggle Financially; and Ice Cream in a Minute!

Quick Bites: Middle-Class Consumers Feeling Pressure

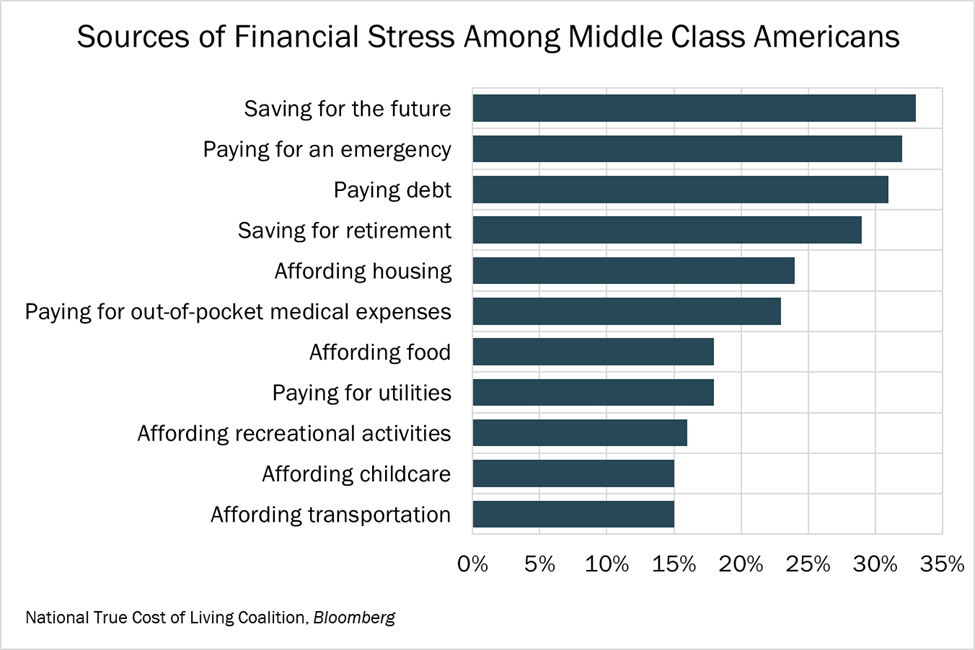

- Most middle-class Americans say they’re struggling financially, and a portion say they’re having trouble putting food on the table. Among 2,500 adults who make 200% of the federal poverty level – $60,000 for a family of four – 65% say they’re having a hard time making ends meet. And, among those, 18% say they feel extreme stress around affording food, per findings by the National True Cost of Living Coalition.

- To cope, most consumers – 92%, per a survey by CNBC and Morning Consult – are cutting back on spending. Nonessential goods, including entertainment, home décor, clothing and appliances, have taken the biggest hits, with nearly 80% reporting spending less in those categories. Many have also curbed purchases of essentials, with two-third of respondents saying they’ve opted for cheaper products or are buying less.

- As with most food staples, consumers are paying more for dairy. As a result, some shoppers are putting less in their carts, with volume purchases of dairy down 1.6% between 2022 and 2023. But others remain loyal, preferring to save by trading down to private-label products. According to Circana data, store-brand dollar sales outpaced name brands in 10 of 15 dairy categories last year.

- Overall dairy sales may improve further in the coming months. USDA reported prices for dairy products fell 1.3% year-over-year in April, and dairy is one of three categories expected to decline in price in 2024.

Today's Special

- Early studies are examining demographics behind the shoppers who will browse physical and virtual grocery aisles in the coming years. Age-wise, most of those loading up carts will be older, with people ages 65 and older set to outnumber children under 18 by 2034, per data by 84.51°. They’ll also be more diverse. Over the next 10 years, populations of Hispanic, Asian and people of two or more races are set to increase 12%, 13% and 19%, respectively, while the Caucasian population is set to decline by 7%.

- Most of those shoppers will browse products in brick-and-mortar stores. 84.51° found that millennial, Gen X and baby boomer consumers opt to shop in store more often than online. Gen Z shoppers, on the other hand, prefer to buy online for pick up.

- No matter how they shop, dairy is a top purchase. Processed cheese and refrigerated coffee creamers rank among the top five products bought most frequently by Gen Z consumers. Fluid milk and natural cheese score high with millennials, Gen X and baby boomers.

- Retailers are already tailoring their shopping experiences to future consumers. Some are adopting more digital technology, using screens to display ads, labels and pricing. Others are enhancing e-commerce offerings, such as personalized digital coupons and free delivery services.