Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: New Zealand’s Milk Production Decreases; Consumer Sentiment Down While Spending Up; and Pizza in a Minute!

Quick Bites: Sentiment Down, Spending Up

- Consumers are increasingly worried about inflation, the labor market and pressure on their personal savings. Analysis by McKinsey found that after a spike in the first quarter, consumer sentiment in Q2 fell to levels last seen at the end of 2023.

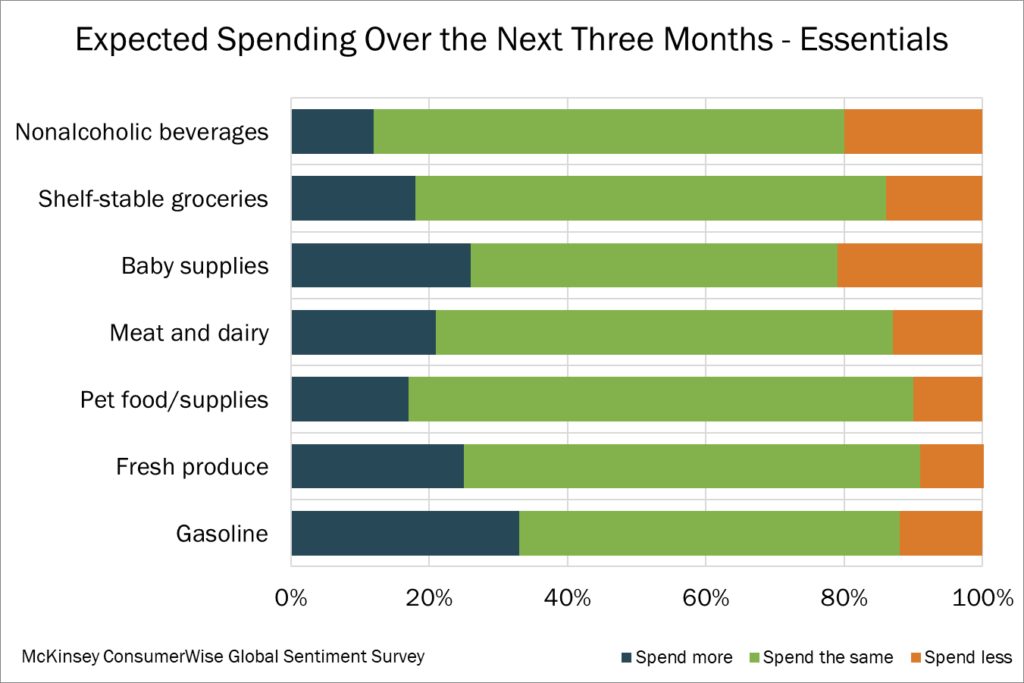

- The primary culprit behind the more pessimistic outlooks: rising prices, which have outpaced targets put in place by the Federal Reserve. Respondents to McKinsey’s survey noticed they’re paying more for food, particularly fresh produce, meat and dairy. Per scanner data, butter prices increased by an average of 5% year-over-year in May, though cheese prices decreased 4%. Still, Americans are budgeting more for these products – 21% plan to put more dollars toward meat and dairy, in particular, while just 13% plan to spend less.

- Shoppers are offsetting increased food spending with pullbacks in discretionary categories. In the next three months, 49% will purchase less furniture, 48% will spend less on home decorations and products and 47% will buy fewer pieces of jewelry.

Today's Special

- New Zealand’s milk production decreased in May for the third consecutive month. On a milk-solids basis, production was down 4.3% year-over-year, and on a tonnage basis, production slipped 6.2% on the year. Still, output is roughly in line with the rolling five-year average. Looking ahead, milk production is seasonally lower in June, and recent pasture readings are at the lower end of the historical average.

- New Zealand officials confirmed agriculture will remain exempt from the country’s Emissions Trading Scheme. It was a move praised by New Zealand dairy producers. Agriculture emissions have never been included in New Zealand’s emission trading but were set to be included in 2025. The new government, elected late last year, made good on an election promise, amending the Climate Change Response Act to exempt all agriculture. Instead, a newly formed working group made up of industry leaders will examine tech-based methods to reduce biogenic methane emissions.

- On the other hand, changes to the Accredited Employer Work Visa program in New Zealand are creating significant concern across its dairy industry. Under the new changes, most farm laborers will receive shorter visas, be required to demonstrate a minimum standard of English, and must meet a minimal skill/experience threshold. Concerns exist that these changes may limit populations across the region who had previously been eligible laborers, as well as potentially forcing farmers to send skilled and valuable laborers home early in exchange for new workers, thereby creating more frequent training demands on farmers.

- On the demand side, New Zealand’s year-to-date exports look lackluster. Cheese sales for the first four months of 2024 declined 10%, while butter shipments fell 9%. Milk powder exports were also down slightly versus prior-year levels.