Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: USDA Issues FMMO Recommended Decision; Butter Concerns Ahead of Holidays; and Fourth of July Spending in a Minute!

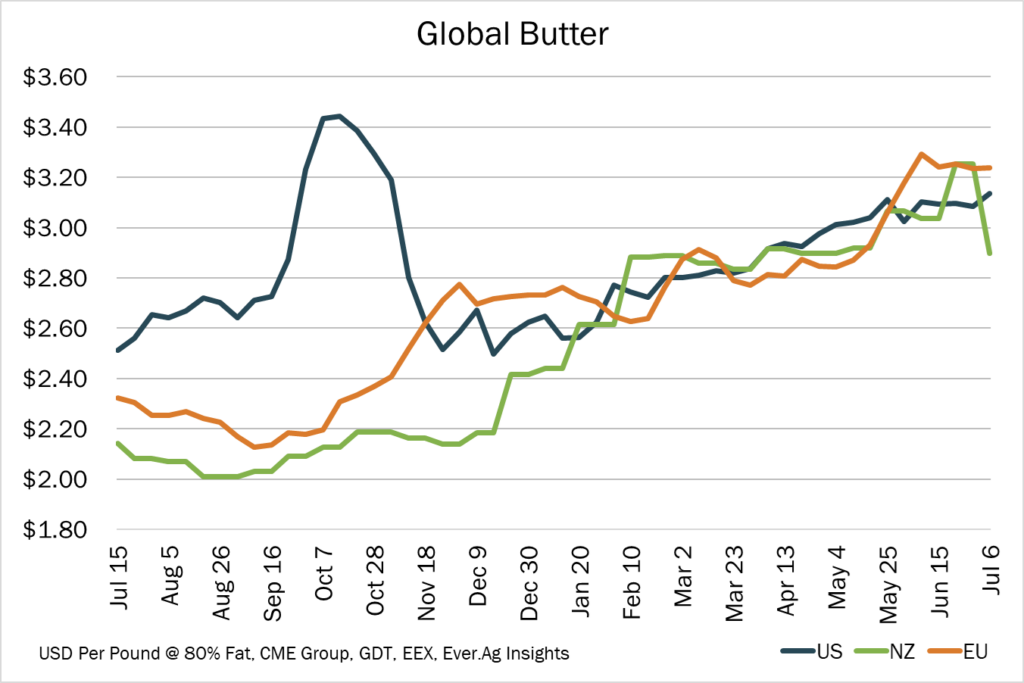

Quick Bites: Butter Concerns Ahead of Holidays

- Snug butter supplies and higher prices across the globe are causing concern around availability and sales ahead of the holiday baking season. Values in New Zealand hit a record-high $7,350 per metric ton (or $3.33 per pound adjusted to an international standard of 82% butterfat) at the June 18 GlobalDairyTrade auction, before easing to $2.97 at the July 2 event. Similarly, EU butter prices reached $3.24 per pound last week, up more than 40% year-over-year.

- The story is much the same in the U.S., where spot butter continues to trade above $3.00 per pound. Higher prices are being passed onto consumers, who paid an average of $4.95 per pound in June, 7% higher than last year, per scanner data. Shoppers, in turn, pulled back on purchases, with retail butter sales down nearly 1% on the year last month.

- Is any relief ahead? USDA data shows bulk butter stocks reached a healthy 380 million pounds as of May 31, up 3.4% (+12 million pounds) year-over-year. But recent CME price increases suggest buyers are still anxious about getting their hands on supply. That could keep retail prices elevated, though grocers are hoping promotions entice consumers to spend anyway. In June, an average of 5,500 retailers per week ran deals on butter, 3% more than the same period last year.

Today's Special

- Following months of hearings, USDA last week issued its Recommended Decision regarding federal milk market orders (FMMOs). Overall, analysis based on markets since January 2021 suggests the changes will significantly increase Class I prices while lowering Class II, III and IV prices. The recommendations cover and amend five general areas of milk pricing.

- USDA plans to revert to the higher-of Class III or Class IV price as the base for setting about 90% of Class I milk volume. The new recommendation could create a more volatile Class I mover and compromise the ability of most Class I processors and customers to manage risk. USDA also recommends a separate Class I pricing formula for Extended Shelf Life (ESL) dairy products with a shelf life of over 60 days based on a rolling average of Class III and IV prices, adjusted monthly - using a two year lag - to reflect a historical difference between the two classes.

- USDA significantly increases Class I Differentials by a simple average of nearly $1.40 per hundredweight for all counties. The largest changes are in the Mideast, Northeast and Southeast regions.

- Class I milk prices will also be significantly increased by USDA’s recommendation to lift the assumed solid levels in skim milk to reflect gains in milk component levels over the past 24 years. Revisions will include increasing skim milk true protein levels 3.1% to 3.3%, other solids levels from 5.9% to 6.0%, and total nonfat solids from 9.0% to 9.3%.

- Consistent with IDFA’s proposal, USDA proposed new make allowances for manufacturing milk, but they fall 3-5 cents short of fully reflecting the manufacturing costs per pound determined by the most recent cost studies. The cheese make allowance was raised about 5 cents to 25.04 cents per pound, butter increased 5.4 cents to 22.57 cents, nonfat dry milk climbed 5.9 cents to 22.68 cents, and dry whey increased 6.6 cents to 26.53 cents.

- USDA also agreed to exclude the use of 500-pound cheddar barrels in the calculation of Class III milk prices and raised the butterfat factor in the Class III protein price by 1%.

- IDFA members can access the IDFA’s analysis of USDA’s Recommended Decision here. IDFA is currently conducting a more thorough review of the decision and will be providing comments to USDA.