Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Ocean Freight Rates Reach Near-Pandemic Levels; Inflation Driving More Consumers to Bargain Outlets; and Back-to-School Spending in a Minute!

Quick Bites: Chowing Down on Bargains

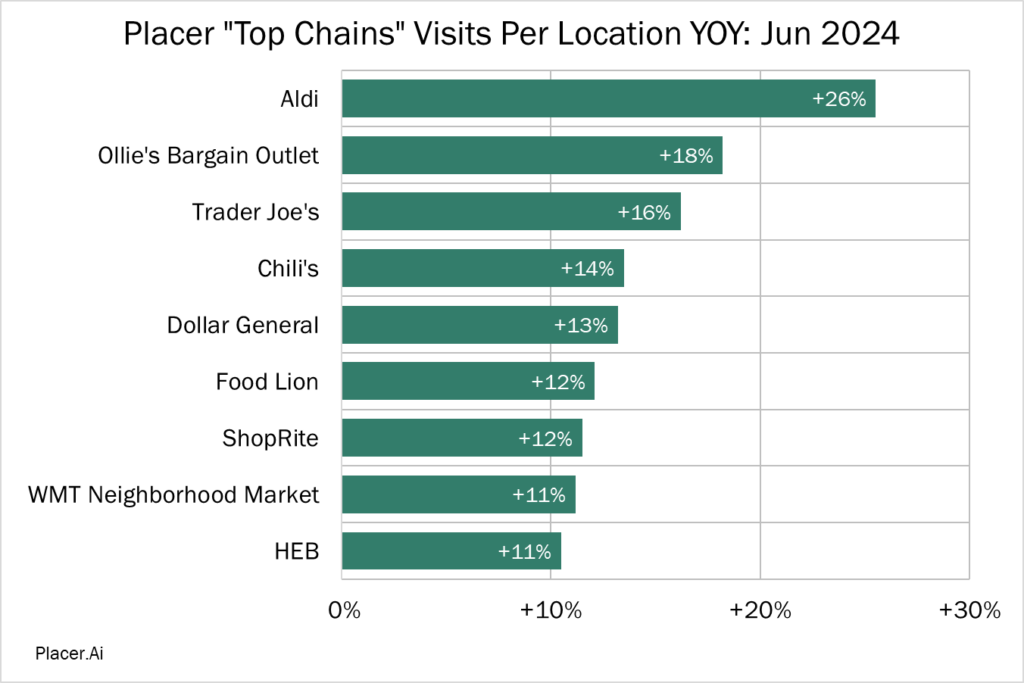

- Inflation remains a top factor driving consumer spending. And as they try to make their dollars stretch further, shoppers and diners are opting for bargain options.

- According to Placer.ai, discount grocer Aldi saw a 26% year-over-year increase in foot traffic in June in existing locations. Aldi promotes itself as being “#1 in everyday low price” – an assertion backed up by surveys showing prices running 5% or more below other major chains.

- When it comes to dining out, meal deals are popular. In a Placer.aI ranking of foot traffic at food establishments, popular restaurant Chili’s was the only non-grocery store to make the list. Why? Chili’s budget friendly “3 for Me," which allows consumers to purchase a drink, appetizer and entrée, starts at $10.99 – generally less than the average price of a fast-food combo. According to anecdotal reports, lower-priced deals are also bringing consumers to chains like McDonald’s, Wendy’s and Burger King.

- From a dairy perspective, the big question seems to be: Are we just moving dollars around, or is dairy product demand changing materially for better or worse? Anecdotal and published reports suggest that demand may be improving some, but not dramatically.

Today's Special

- Ocean freight rates are reapproaching pandemic peaks amid increased congestion. Rates from China to the U.S. West Coast topped $7,800 per 40-foot container as of July 16, up more than 300% year-over-year. Analysts with DHL noted increased costs for U.S. trade competitors, too, including transpacific trade routes and lanes from Asia to Europe. Per Xeneta, rates from China to South America pushed above $9,100, while costs to move goods from China to North Europe are nearing $8,500.

- Disruptions along the Red Sea corridor are partially to blame. Amid conflict in the Middle East, most container ships are avoiding the Suez Canal, opting to take a longer but safer route around the Cape of Good Hope. The extended voyage times are disrupting shipping schedules and causing weeks long delays.

- Global dairy trade is feeling the impact. Prior to the pandemic, the Suez Canal Authority (SCA) reported more than 2 million tons of foodstuffs moved through the channel each year. While SCA has yet to release current data, Egypt’s Al-Mal News reported a nearly 69% year-over-year drop in cargo volume along the canal in June.

- Some relief may be ahead. Media reports suggest negotiators are nearing a ceasefire deal, though it may take months for the Suez Canal to fully reopen once the conflict ends. In the meantime, some shipowners are adding new vessels to their fleets.

- U.S. shippers are also monitoring labor deal talks among East and Gulf coast dockworkers. The International Longshoremen’s Association, which represents about 45,000 port employees, withdrew from negotiations in June. With the current contract set to expire on September 30, concerns about strikes are mounting. While dairy isn’t exported out of Gulf Coast ports, more than 150,000 metric tons shipped out of the five largest East Coast gateways last year. Meanwhile, little dairy is imported through the East Coast, but nearly 56,000 metric tons came in through Gulf Coast gateways in 2023.

- Given the uncertainty along global shipping lanes – and the upcoming holiday season – U.S. importers are placing larger, earlier orders. In a July report, the National Retail Federation stated the U.S. is experiencing its largest import volumes in two years, and inbound shipments are expected to rise 7% year-over-year between July and November.