Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Dairy Processing Capacity Expanding; QSR's Try New Ways of Engaging Consumers; and Adaptive Retail in a Minute!

Quick Bites: A Slice of Spending

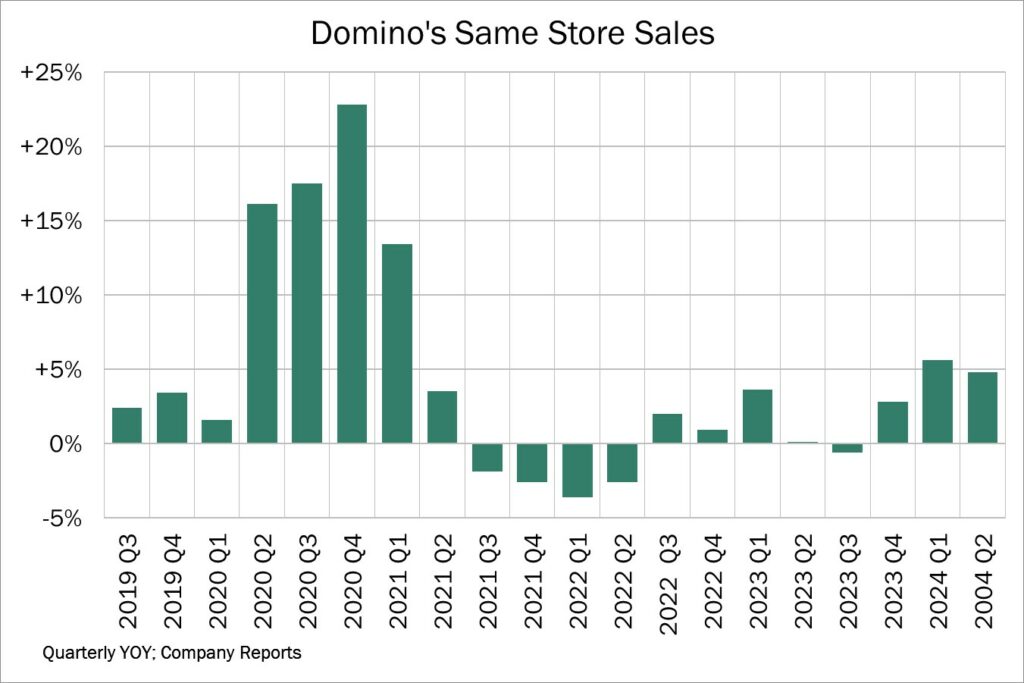

- As consumers continue to hunt for value, Domino’s has found a way to capture a slice of restaurant spending and increase same-store sales. The chain’s “Hungry for MORE” program, which focuses on food innovation and operational efficiency, helped propel same-store sales up 4.8% in the second quarter. The pizza chain also relaunched its loyalty program in September, lowering the spending threshold from $10 to $5 for delivery and allowing customers ordering the popular “$7.99 carryout deal” to accumulate points through the store’s app.

- Domino’s isn’t the only quick-service concept focused on reengaging the consumer. Other popular fast-food eateries like Burger King, Wendy’s and Taco Bell have also pushed promotions and value meals, and their efforts may be getting more people through their doors. Foot traffic at all QSRs eased just 2.3% year-over-year in Q2, an uptick from -3.5% in Q1. And data by Placer.Ai shows foot traffic is off to a positive start for Q3, rising 3.4% year-over-year during the first three weeks of July.

- While foot traffic may be picking up, consumers remain cautious. Quarterly sales for some chains are still suffering - Starbucks same-store sales dropped 2.0% in Q2, while McDonald’s sales slipped 0.7%.

Today's Special

- Estimates suggest roughly $7 billion in U.S. dairy processing capacity is slated to come online in the next few years. Many of the expansions and new builds are slated for areas with healthy on-farm margins and room for producers to expand, including New York, South Dakota and Texas.

- A medium-sized cheese plant opened in Idaho this year, with an additional six facilities set to come online next year in Minnesota, South Dakota, Texas and Wisconsin. A Wisconsin dairy manufacturer also broke ground this month on 20,000 square feet of renovations and 60,000 square feet of new construction on an existing facility. Meanwhile, some cheese manufacturers are expanding non-dairy capabilities. Leprino Foods Co. recently announced a partnership with Fooditive Group to commercialize non-animal casein. With the agreement, Leprino holds exclusive rights to market and distribute the casein for cheese.

- Processors are also expanding fluid bottling capabilities. Two ESL/aseptic milk facilities are set to open this year in California and Idaho. Another five are expected to come online in 2025 in Georgia, New York, Ohio and Texas.

- Additional Class IV processing is also planned, including two milk powder plants and three ice cream facilities slated to be operational this year. The sites are located in Illinois, Indiana, Texas and Washington. An additional powder plant is planned for Idaho next year, as well as expansions to an ice cream facility and Greek yogurt and cottage cheese capacity in New York.

- A number of new plants are also planned across the globe. Recent announcements include an investment by Müller in a new production facility in Germany. The plant will create jarred yogurt. Vietnamese dairy company TH Group broke ground on a dairy farm and processing plant in Russia, with the project’s price tag estimated at $204 million.

- On the other hand, a number of small- and medium-sized U.S. dairy plants are expected to shutter in the next couple of years. Four cheese plants, a fluid bottling facility and a cheese/fluid plant are expected to close their doors next year. Another three cheese production facilities are slated to shut down in 2025.