Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Mexico's Purchasing Power; a Macroeconomic Update; and Private Label Trends in a Minute!

Quick Bites: Mexico's Purchasing Power

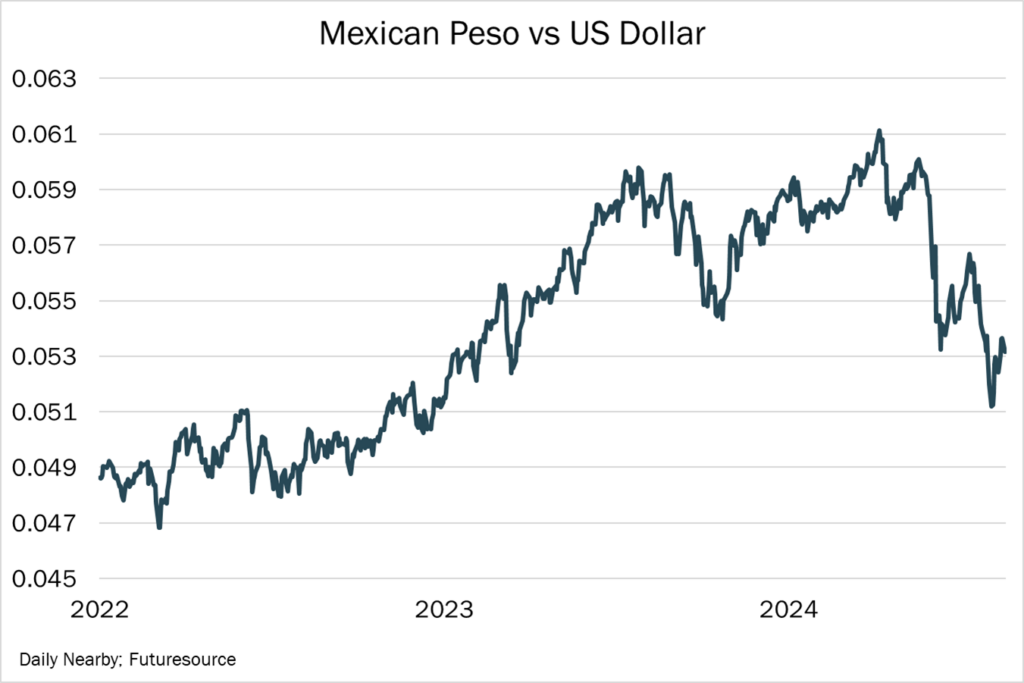

- The Mexican peso is showing signs of weakness amid slower economic growth and weaker consumer confidence. That’s potentially concerning for U.S. dairy exporters, as economic and currency strength helped buoy shipments earlier this year.

- After reaching a five-year high in June, Mexican consumer confidence tumbled in July on lower expectations for the economy and uncertainty around personal finance and savings. A recent rate cut by the country’s central bank also raised questions, as Mexico’s rate of inflation remains well above 5% and ahead of targets.

- As a result, Mexico’s purchasing power and dairy demand could weaken in the months ahead. Though perhaps unrelated at this juncture, U.S. exports across the Southern border are already slowing, with cheese sales reaching 32 million pounds in June, down 21% from May, though still up 26% on the year. Exports of NDM/SMP also eased to 65 million pounds, a 15% decline from the month prior and a drop of 25% year-over-year.

Today's Special

- A weaker-than-expected July jobs report triggered a global market correction in early August. Unemployment rose to 4.3% in July, the highest level since October 2021, while payrolls expanded by 114,000 jobs, well below expectations for 180,000. The subdued report triggered fears of a recession, and many wondered if the Federal Reserve had waited too long to reduce interest rates. The S&P lost 3% in a single day on August 5, and most stocks and commodities slipped, as well. Prices have rebounded since, though some anxieties remain around the broader economic landscape.

- Further support for interest rate cuts came following the July CPI report. Prices on goods and services remained fairly steady, climbing 0.2% from June to July, though prices increased 2.9% on the year. Even so, that is an improvement from the 3.1% gain seen the previous month. The slight dip in inflation probably may not mean much to the average American consumer, but it is something the Federal Reserve will make note of as it considers a rate cut this fall.

- With consumers feeling pinched, overall retail sales lagged behind inflation in July, but performance exceeded expectations. Sales totaled $709.7 billion, up 1.0% month-over-month and +2.8% year-over-year. More people are choosing to cook at home, as grocery store sales were up 1.0% on the month and +2.6% since July 2023.

- In response, experts believe the Federal Reserve may lower interest rates by 25 basis points in September, November and December. Such a move would bring interest rates into the 4.50%-4.75% by the end of the year.