Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Tight European Milk Supply; Easing Fuel Prices; and Fluid Milk Sales in a Minute!

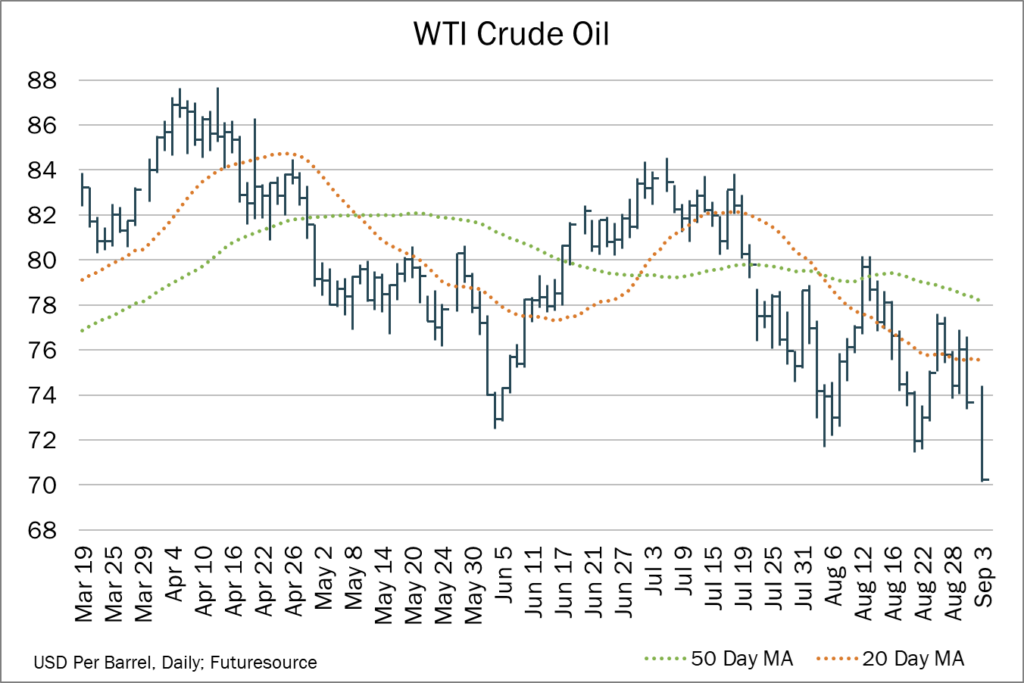

Quick Bites: Crude, Fuel Prices to Ease

- Concerns around oil and fuel demand persist, bringing crude prices downward even as military conflict rocks the Middle East. That could be good news for American consumers facing higher prices for everyday staples.

- OPEC this month revised its outlook 2024, forecasting global demand will increase by 2.11 million barrels per day. That was down from previous expectations for 2.25 million. The International Energy Agency also revised its growth outlook for 2025 to 950,000 barrels per day, down from previous forecasts for 970,000. Both agencies said the decreases stemmed from poor demand and economic struggles in China.

- As a result, consumers could pay less at the pump, even as they pay more for other products. Analysis by GasBuddy suggests that the national average gasoline price could fall below $3 per gallon this fall and winter. Already, recent prices for regular unleaded are 50 cents per gallon below year-prior levels. The U.S. Energy Information Administration also expects national retail gas prices to average $3.33 per gallon next year, down from $3.38 in 2024.

Today's Special

- Tighter milk supplies in Europe are supporting higher prices across the region. EU cheese prices finished August at $2.32 per pound, compared to $2.18 per pound in the U.S. and $1.94 per pound in New Zealand. Similarly, EU butter prices averaged a lofty $3.85 per pound (adjusted to 80% butterfat), compared to $3.19 per pound domestically and $2.97 in New Zealand.

- Increasing cases of Bluetongue virus (BTV) are curtailing production in parts of the region. The virus – which is transmitted by insects and affects sheep and cows – has been detected in Germany, France, Luxemborg, Denmark, the Netherlands and the UK. The disease is reported to cause a dramatic drop in milk output. It may also have a long-term impact as some producers report infertility and hoof injury that leads to early culling.

- Milk solids are not keeping pace with volume. Earlier this summer, European milk production showed signs of improvement. Despite seasonal warmth and less favorable pasture conditions, output in the EU rose 0.9% year-over-year in June, driven by increased output in key producing regions. But fat output was negative: down 0.5%. Recent reports note that summer milk is “thin” and not producing the finished products the same volume did in the past, lending support to prices.