Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Robust Grain Harvest Expected; Consumer Sentiment Improving; and Mexican Milk Production and Imports in a Minute!

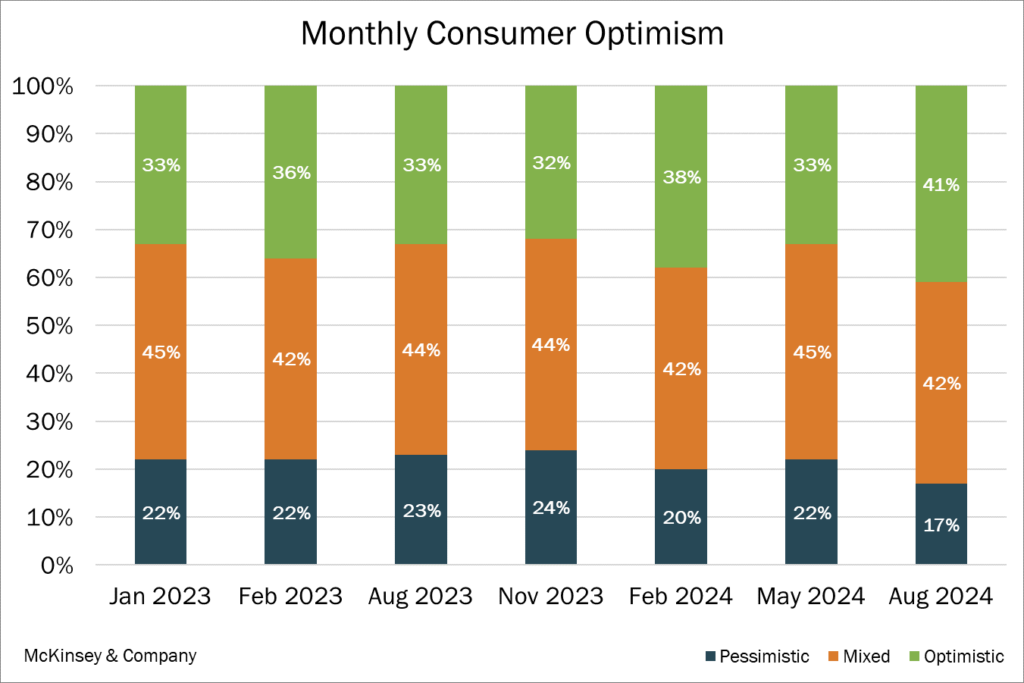

Quick Bites: Consumer Sentiment Improving

- Optimism in the strength of the U.S. economy increased in the third quarter of 2024 to the highest level in a year. However, U.S. consumers are still oscillating between a willingness to splurge and being cautious about spending.

- Age, not income, appears to be the greatest determinant in economic outlook, according to data collected by McKinsey & Company. Gen Z and millennials expressed the highest optimism in the economy, compared to Gen Xers and Baby Boomers. Data also found 47% of male respondents were optimistic about the economy, compared to 37% of females.

- While inflation has consistently cooled over the past few months, 53% of survey respondents said that higher prices are still their number one concern.

- As prices show signs of stabilizing, however, some consumers are more willing to open their wallets. Consumers indicated they plan to increase spending on essential, semi-discretionary and discretionary items over the next three months, with 20% saying they are more likely to increase spending on dairy and meat products and 18% more likely to spend on shelf-stable groceries.

Today's Special

- As harvesters prepare to roll across the U.S., data points to sizeable corn and soybean crops. In its latest World Agricultural Supply and Demand Estimates report, USDA increased corn yield estimates despite hot conditions in August. If the higher forecast is realized, U.S. corn production could reach 15.186 billion bushels this year.

- Soybean yield estimates are also robust, and could produce 4.586 billion bushels, per USDA data. That would come close to levels last seen during the 2019-2020 crop year.

- Both crops will pile on top of already ample corn and soybean stocks. Amid slower exports, USDA estimated U.S. corn inventories at 2.057 billion bushels as of the end of August, while soybean stocks came in at 550 million bushels.

- Hefty stocks are already putting pressure on grain markets. Corn futures dropped below $4.00 per bushel this month, while soybean contracts are trading under $10.00. That’s good news for U.S. dairymen, who will likely pay less for feed in the coming months. As of September 13, estimates put feed costs for the second half of 2024 just above $10.00 per hundredweight of milk. In 2025, feed costs are expected to average just over $10.50 per hundredweight.

- As a result, producers are looking at the healthiest on-farm margins in some time – at least on paper. However, other input costs, such as fertilizer, along with macroeconomic factors, like high interest rates, remain key watch factors.

- In addition to harvest progress, grain market watchers will closely monitor transportation issues in the coming weeks. Dry conditions along the Mississippi River have reduced water levels, hindering the movement of grain across the U.S. and into export channels. If movement remains limited, additional grain could remain on U.S. shores, pulling grain prices down further.

- Another area of focus: South American crop conditions. Brazil is preparing to plant its second corn crop, also known as the safrinha crop. However, unfavorable weather conditions could cut into crop production. Already, dryness is reportedly inhibiting the movement of grain along key South American riverways.