Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Update on Chinese Dairy Industry; Trouble on the Water; and Halloween Spending Expectations in a Minute!

Quick Bites: Trouble on the Water

- Nearly 50,000 members of the International Longshoremen’s Association went on strike this week after a previous labor contract expired. Work stoppages are impacting ocean freight at gateways across the U.S. East and Gulf coasts.

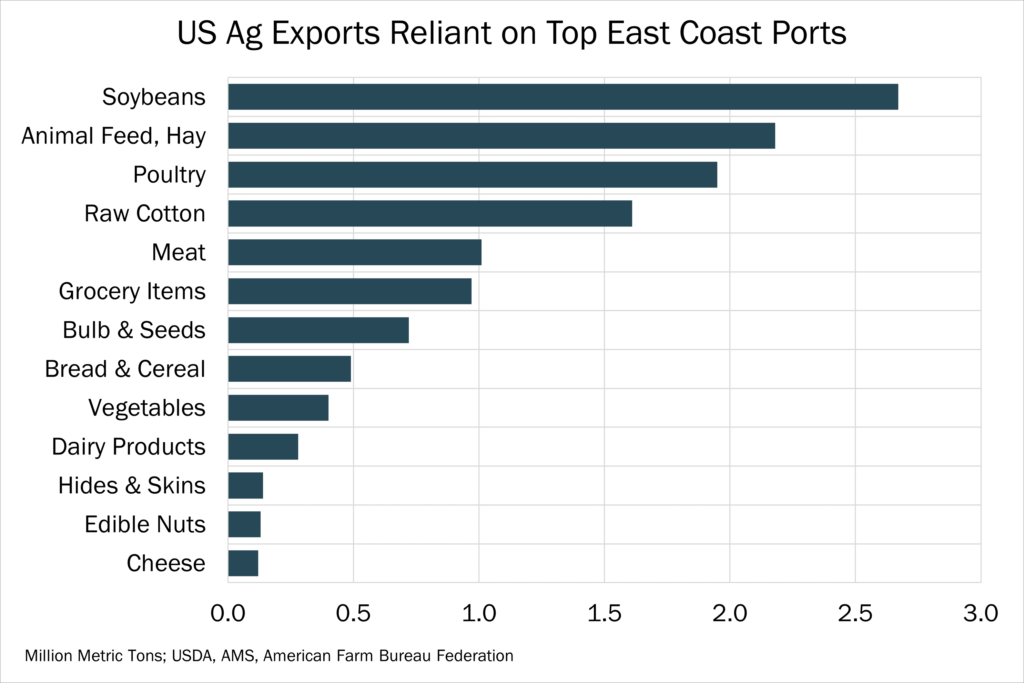

- The strikes could have major implications for U.S. agricultural imports and exports. About 46% of containerized agricultural exports (16.6 million tons) depart through East Coast ports. Looking at a product-by-product breakdown, about 30% of all waterborne dairy exports route through ports impacted by the strike.

- To circumnavigate port closures, many importers have ordered goods early and/or are re-routing containers to West Coast ports. However, with the Panama Canal still recovering from drought, conflict in the Red Sea and congestion due to increased shipping activity, West Coast shipping rates are climbing. As a result, some shippers have halted East-bound exports altogether rather than re-route.

- Shipments out of West Coast ports climbed over the summer. Ag exports between May and June increased from the ports of Los Angeles (+28%), Seattle (+26%) and Oakland (+15%). Meanwhile, the top five ag-exporting ports along the East coast saw a 10% year-over-year decrease in volume during the same May-June time period.

- Looking ahead, estimates by the American Farm Bureau Federation suggest a one-week closure of East coast ports could cause $318 million worth of economic disruptions to the agricultural industry.

Today's Special

- China’s milk production dipped for a second consecutive month in July, down 1.7% year-over-year, as higher temperatures and increased humidity weighed on cow comfort. CNAgri reported milk prices in the country’s top 10 milk-producing provinces also fell to $3.25 per kilogram for the month, 14% lower on the year. Those decreases continued in August, with prices reported at $3.21 per kilogram, down nearly 15% compared to prior-year levels. According to Reuters, milk prices are now below average producer break-even levels.

- However, the country’s milk supplies are far outpacing demand. In 2022, the last year for which data is available, Chinese milk consumption reached 12.2 kilograms per capita, down roughly 14% year-over-year. Analysts attribute the drop to an aging population and slowing birth rate. China’s economic struggles are also cutting into sales of products like cheese, butter and cream.

- Meanwhile, China’s milk production neared 42 million tons in 2023 as Beijing pushes for dairy self-sufficiency. Last year’s output surpassed government targets of 41 million tons and cemented China as the world's third-largest producer.

- The supply and demand challenges are weighing on China’s dairy companies. For the first half of the year, China Mengniu Dairy Company reported “lower-than-expected consumer demand” depressed sales of fluid milk (-13% year-over-year), ice cream (-22%) and milk powder (-14%). Inner Mongolia Yili Industrial Group also reported drops in sales of liquid milk (-13%) and ice cream (-20%).

- Could glimmers of hope be on the horizon? Through September, China increased purchases on the GlobalDairyTrade platform for five consecutive events. However, some analysts suggest the activity may be more seasonal than tied to a rebound in demand. China’s central bank also announced last month a stimulus packages aimed at drumming up consumer spending and supporting the country’s real estate sector. The policies included cutting key short-erm interest rates, lower borrowing costs and easing restrictions for second-home purchases.