Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Cheese Exports; Frozen Pizza Sales Rise; and an Update on Cheese Markets in a Minute!

Quick Bites: Frozen Pizza Sales Rise

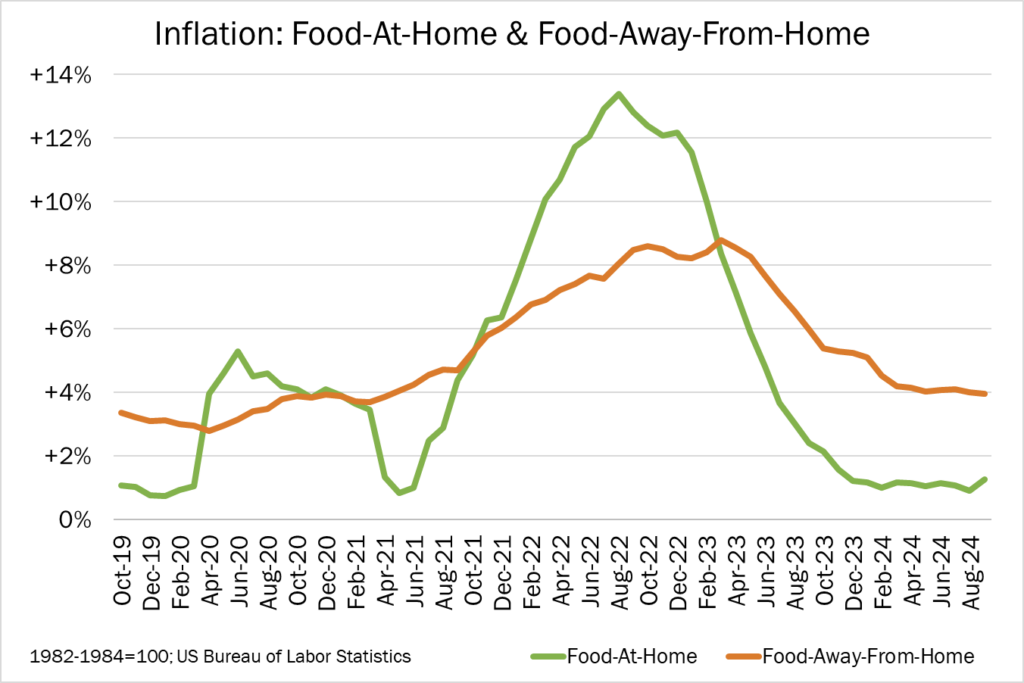

- Headline inflation cooled ever so slightly in September. Prices on goods and services rose 2.4% year-over-year, down from 2.5% in August. Food prices, however, continue to be at the forefront of consumers’ minds, with restaurant prices up 3.9% and grocery store prices +1.3% year-over-year.

- With the cost of eating out hitting wallets hard, consumers are hunting for more affordable alternatives in the grocery store aisle. Frozen pizza sales are up sharply year-over-year, with the average frozen pepperoni pizza in Madison, Wisconsin, costing roughly $5, while the average cost of the same pie at a traditional pizzeria comes in at $13.

- Leading pizza restaurants have missed their quarterly sales for the first half of 2024, with Q3 earnings also expected to fall short. Dominos has already posted Q3 results, with U.S. same-store sales growing 3.0%, behind expectations of a 3.6% increase.

Today's Special

- U.S. cheese exports defied expectations and not especially competitive pricing in August. Outbound shipments totaled 94 million pounds, up 15% on the year. That took year-to-date sales to 766 million pounds, 22% higher compared to the same period in 2023. Mexico remains a top buyer, with year-to-date exports to the country up 36% on the year. The U.S. is also gaining traction in South Korea – exports for the first eight months increased 38% over prior-year levels.

- On the other hand, exports of NDM + SMP continued to struggle amid slower production, smaller stocks and, at times, the highest prices in the world. Sales reached 150 million pounds in August, 1% lower versus 2023. That took shipments for the first eight months to 1.14 billion pounds, down 7% year-over-year. Sales to Mexico are down 11% year-to-date, while exports to China are 41% lower.

- The U.S. remains a net importer of butter. August imports rose to 14 million pounds, a 58% gain from the previous year. Year-to-date imports stand at 99 million pounds, an increase of 30% from 2023. Much of that – nearly 70 million pounds – shipped from Ireland. Exports, meanwhile, reached 6 million pounds, up 16% year-over-year. Outbound volume for the first eight months, at 44 million pounds, declined 5% on the year.

- Whey exports gained traction in August, climbing to 36 million pounds, a 21% bump from the year before. Year-to-date shipments of 267 million pounds were even with 2023 levels.

- Looking ahead, a number of factors could make U.S. dairy more competitive in international markets. Further rate cuts by the Federal Reserve could weaken the U.S. dollar, giving global buyers more purchasing power. EU prices also remain elevated amid concerns around the Bluetongue virus. That could make U.S. product and pricing more appealing.