Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Bumper Crops and Export Competition Likely To Keep Lid on Grain Prices; Holiday Promotions Ramping Up; and Holiday Spending in a Minute!

Quick Bites: Holiday Bargain Hunting

- With consumers pinching pennies, retailers are ramping up holiday promotion tactics and discount shopping days in an effort to capture larger market shares. Thanksgiving and Christmas items are already hitting store shelves, and Salesforce predicts U.S. sales from November to December will reach $277 billion, a 2% increase year-over-year.

- Early reports suggest shoppers will be more price sensitive than ever as they approach the holidays. During Amazon’s Prime Day event in October, retailers offering significant discounts saw U.S. sales rise 3%, the first increase in years, Salesforce reported. More discounts are likely ahead, with retailers expected to offer larger promotions on top sellers and/or new products, Forbes reported.

- Some companies are also expanding their holiday promotional calendars. With five fewer days between Thanksgiving and Christmas compared to 2023, Amazon is extending its cyber week shopping period from five days to 12. More retailers are expected to follow – marketing agency Envision Horizons reports all its clients plan to run promotions for Black Friday and Cyber Monday.

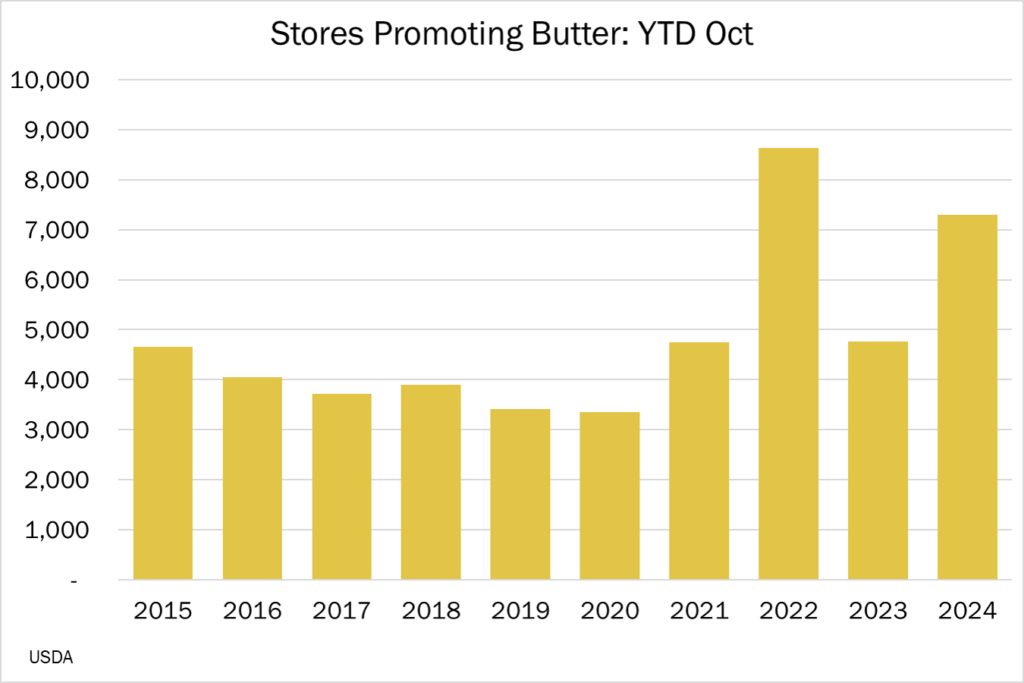

- Grocers are also capitalizing early on preparations for the holiday season. An average of 5,135 stores ran promotions for butter per week in October, up 16% year-over-year and those promotions are pushing volume sales. Butter volume sales were up 4% year-over-year for week 44, ending October 27, settling in positive territory for the fourth straight week. Weeks 47 and 48 are historically big butter buying weeks. In 2023 they averaged 36 million pounds, nearly double the full-year average.

Today's Special

- U.S. corn and soybean harvests are nearly complete, and reports point to bumper crops. USDA’s latest World Agricultural Supply and Demand Estimates report pegged corn production at 15.143 billion bushels, while soybean production came in at 4.461 billion bushels. Anecdotal reports also suggest healthy, if not record, yields.

- Newly harvested crops will pile on top of already heavy U.S. grain stocks. Ending corn inventories for the 2024-25 crop year are estimated at 1.983 billion bushels, while soybean supplies are forecast at 470 million bushels.

- The weight of that grain has kept pressure on corn and soybean futures and made U.S. product more competitive in international markets. Accumulated corn exports for the 2024-25 crop year reached 265,899 metric tons as of October 31, nearly 200,000 metric tons ahead of the five-year average. While soybean shipments trail the five-year average, crop-year-to-date sales still stand at a healthy 468,117 metric tons. Outbound volumes could slow in the coming months, however, as South American farmers bring in their own record crops.

- South American corn and soybeans are benefitting from improved weather. Though dry conditions delayed early soybean planting in Brazil, rainfall has helped farmers in Matto Grosso catch up, with an estimated 80% of the crop in the ground as of November 1. Argentina’s corn planting progress also continues apace, nearing 40% complete during the week ending November 7, well above the five-year average.

- As abundant supplies and export competition keep a lid on grain prices, dairy producers could benefit. According to Dairy Margin Coverage models, feed costs in 2025 could average roughly $10.30 per hundredweight. That would put on-farm margins close to a record $13.00 per hundredweight.