Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Holiday Retail Trends; Butter and Cheese Spending on the Rise; and U.S. Milk Powders in a Minute!

Quick Bites: Butter, Cheese Retail Spending Climbs for Holidays

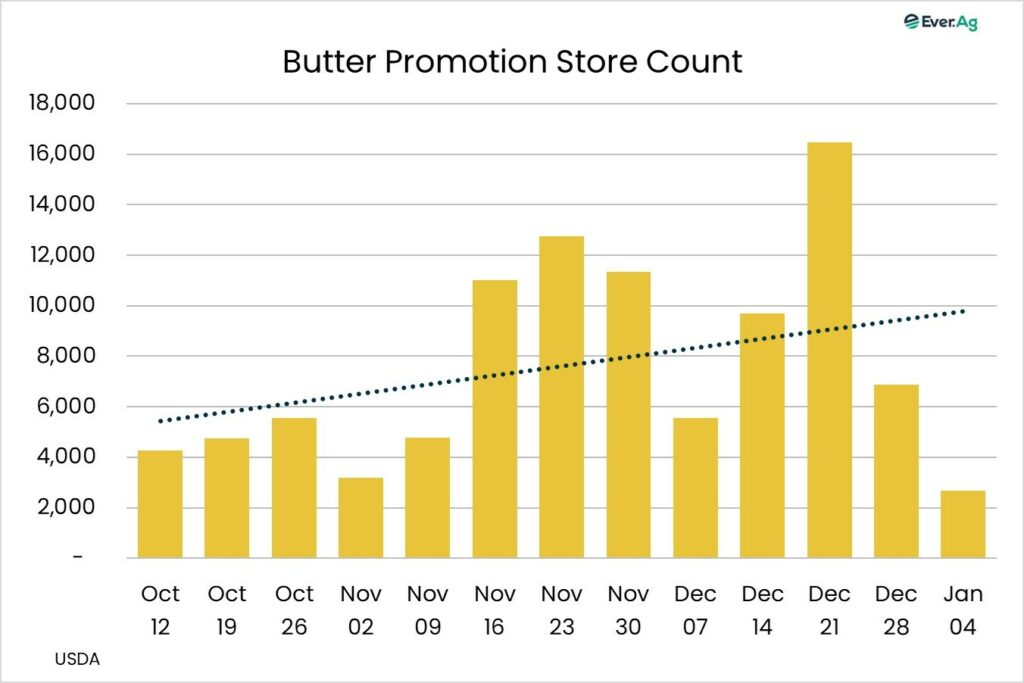

- Butter and cheese retail promotions kicked higher over the holiday season with an average of 9,130 stores promoting butter and 12,660 stores promoting shredded cheese in November and December. Promotional prices were pretty attractive for consumers over the two-month period, trending well below 2023 levels. Average promotional shredded cheese prices came in around $2.49 per pound, down from $2.57 last year and the lowest holiday prices since 2021.

- It was a similar story for butter promotions as anecdotal reports suggest weak commodity prices heading into the fall helped drive more aggressive pricing for butter sellers. For November and December, the weighted average promotional butter prices landed at $3.99 per pound, the best holiday butter prices consumers have seen since 2021. Notably, the November price averaged $3.87 per pound – down 7% year-over-year and the best promotional butter price consumers saw all year.

- Did more aggressive price points help move the needle on sales? Early indications suggest that it helped some. Data from Circana shows that from week 45 through week 53, average retail cheese and butter volume sales increased by about 2% year-over-year.

Today's Special

- U.S. consumers were still in the mood to spend this holiday season, hitting online shopping sites, brick-and-mortar stores and restaurants in record numbers. The National Retail Federation estimates spending in November and December exceeded $979 billion, an all-time high.

- According to Mastercard SpendingPulse, for the period from the day after Halloween through Christmas Eve, consumers spent 3.8% more on the year. Restaurant spending was up 6.3%, online sales jumped 6.7% and in-store shopping rose at a more modest 2.9%.

- But, looking closer, the picture isn’t all sunny. Households making more than $100,000 a year drove much of the activity, while signs point to lower-income consumers pulling back as inflation squeezes their wallets.

- Companies like Newell Brands, which includes Graco strollers and Oster kitchen appliances, reported strong demand for their higher-tier items and declining interest for less-expensive product.

- Meanwhile, Dollar Tree and Dollar General said they were noticing pullbacks in their normal consumer base. Stock values of both companies dropped below pre-pandemic levels with the news of declining sales.

- Consumers who did spend more relied more and more on credit. According to LendingTree, 36% of consumers took on debt over the holidays and went into the red an average of $1,181 compared to $1,028 last year. In Q3 2024, credit card debt hit a record $1.17 trillion, up 8% year-over-year, and NerdWallet reported 28% of credit card users still haven’t paid off their Christmas 2023 bills.

- Will lower- and middle-income spending rebound? Or will it continue to slip, flashing warning signs for the retail economy in 2025?