Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Private Label Performance; USDA Cattle Report Updates; and Super Bowl Spending in a Minute!

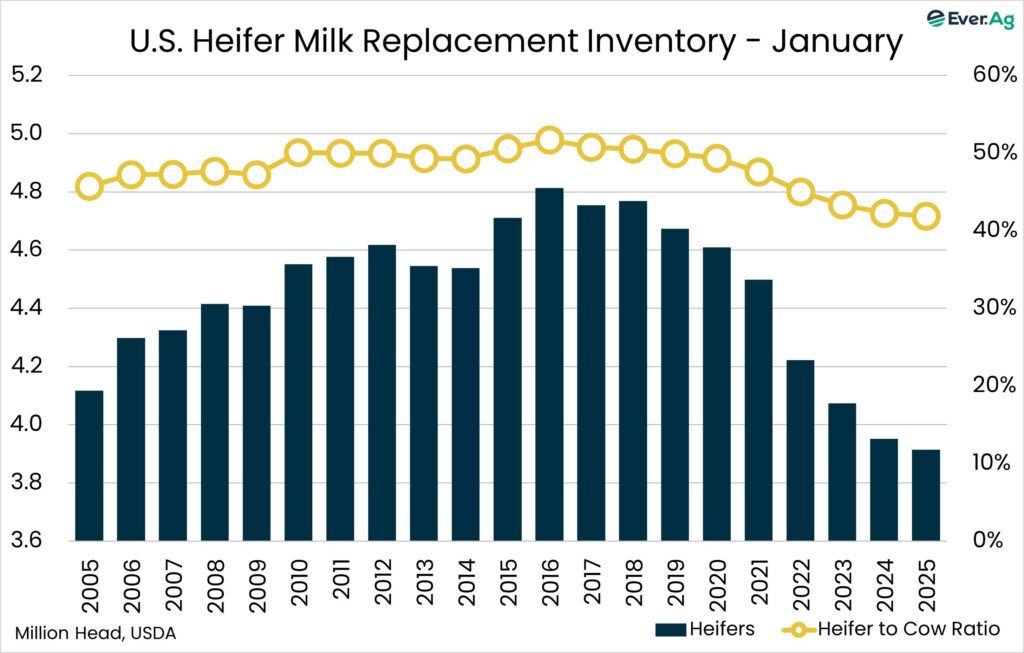

Quick Bites: Heifer Numbers on the Decline

- USDA’s annual Cattle report offered data confirming what many in the dairy industry already knew: heifer inventories are light. If anything, the figures came in lower than expected. The number of heifer replacements declined to 3.91 million, down 0.9% (-40,000 head). The heifer-to-cow ratio dropped to 41.9%, the lowest since 1991.

- On a state level, California’s dairy herd held steady at 1.710 million head despite the HPAI virus hitting herds in the later part of the year. While Texas gained 40,000 cows, Wisconsin dipped by 5,000, Arizona lost 8,000 head.

- From the report, it appears higher beef prices are encouraging more dairy producers to use beef-on-dairy breeding methods, reducing the number of dairy cow replacements. Fewer milk-producing animals in the pipeline raises questions about US milk production in the coming year. Will we see much expansion? Or will fewer heifers keep a lid on output?

Today's Special

- American consumers are still feeling the pinch of inflation. Food-at-home prices are up roughly 25% from four years ago, and while the pace of increase has slowed, shoppers are finding ways to cut back. And one of the major ways they’re doing that is by switching from name brands to private label. In 2024, 42% of U.S. consumers said they bought private label brands to save money.

- In a recent study from Circana and the Private Label Manufacturers Association, store brand sales are hitting record highs. In 2024, private label sales jumped to $271 billion, up 3.9% (+$9 billion) year-over-year compared to +1.0% for name brands.

- Refrigerated foods was the fastest-growing private label category, with sales up 7.5% versus 2023. General food items were next at +4.3%.

- The increased consumer interest in private label is leaving an impression on major retailers. Many are putting more and more emphasis on their own brands to draw in consumers. In recent weeks, Aldi released an extensive report detailing its private label performance. Dollar General announced it’s adding more than 100 private label offerings to its stores in the food and beverage, pet food, personal care and over-the-counter drug categories.

- So far, in the battle to lure shoppers, Walmart and Target are the big winners. Walmart’s upscale Bettergoods and Target’s Dealworthy, both launched in 2024, were the two fastest-growing brands in 2024, each up more than 200% on the year. Target’s Bullseye’s Playground (+109%) and Aldi’s Choceur (+83%) followed.

- While consumers are reaching for store brands more often, opinions on quality are mixed. Of buyers, 59% said private label brands were above-average in value, but only 27% thought they were as good as name brands.