Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Food Inflation; Sports Nutrition Category Growth; and Milkfats in a Minute!

Quick Bites: There's Power in Proteins

- American consumers are hungry for protein. With GLP-1 drug use increasing and younger consumers more health conscious, dairy proteins are in high demand.

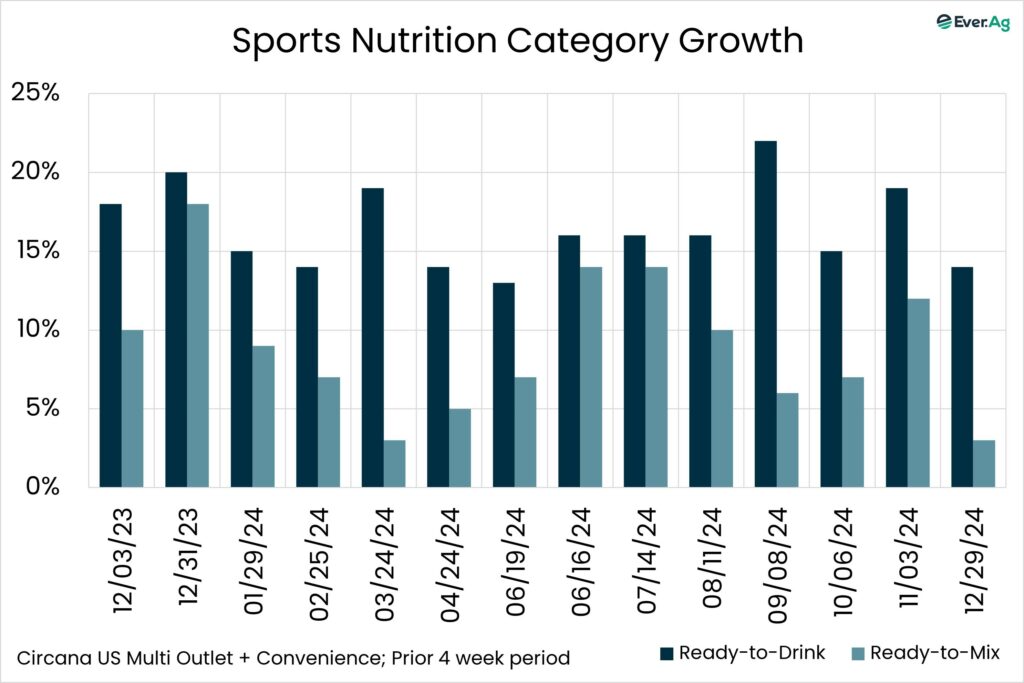

- Recent scanner data indicates that ready-to-drink beverages are booming, up double digits every week for two years now. Ready-to-mix items are also growing, although only by single digits.

- This strong demand is pulling nearly all high protein dairy ingredient supply into production. WPI and WPC 80 stocks are sitting at multi-year low levels, and wholesale powder prices continue to escalate.

- How long can brand owners and private label take the margin squeeze on these products? The last time many sellers took a retail price increase, the category actually grew, so the decision might be easy for some. This time around, there’s more private equity ownership in the space, which may lead to a delay in pricing action as they seek to capture more market share.

- The other question is how consumers respond to higher prices. Will they keep spending because these products are central to their lifestyle? Will they trade down from branded to private label? Or will they find alternative protein sources?

Today's Special

- Inflation. For some time now, it’s been a key topic of conversation about the economy and consumer spending, making headlines and even playing a key role in last year’s presidential election.

- The latest news suggests things aren’t getting better. In February, the Consumer Price Index climbed 0.5% on the month and +3.0% on the year. While that’s a far cry from the highs of 2022, it’s the biggest monthly increase since August 2023 and the biggest annual jump since June 2024.

- On the food side, grocery prices remain stubbornly high. In January, the Food-at-Home Index ticked up by 0.5% on the month and +1.9% on the year compared to +0.3% and +1.8% in December. The effects of bird flu aren’t helping matters. Last month, egg prices surged 53.0% compared to 2024 and that’s showing no sign of slowing down.

- Those high prices continue to sour the consumer mood. The University of Michigan Consumer Sentiment survey reading dropped to 67.8 in February, down from 71.1 in January and 76.9 last year. Analysts had expected the number to increase.

- So, how are Americans coping? According to a recent survey by Deloitte, they’re making adjustments when it comes to food. The highest percentage of respondents (38%) are reducing waste at home, using more of what they buy and, consequently, buying less. That could help explain why grocery spending has been flat-to-lower in recent months.

- Consumers are also buying more private label products (28%), skipping the snacks and sticking to essentials (27%), switching to lower-cost ingredients (25%) or buying less than they’d like (20%).

- Time will tell how long the upward trend will persist. But if inflation continues to get warmer, consumers will likely make more and more changes to their spending habits to compensate.