Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Milk Production Update; Increasing Fluid Milk Sales; and Consumer Sentiment in a Minute!

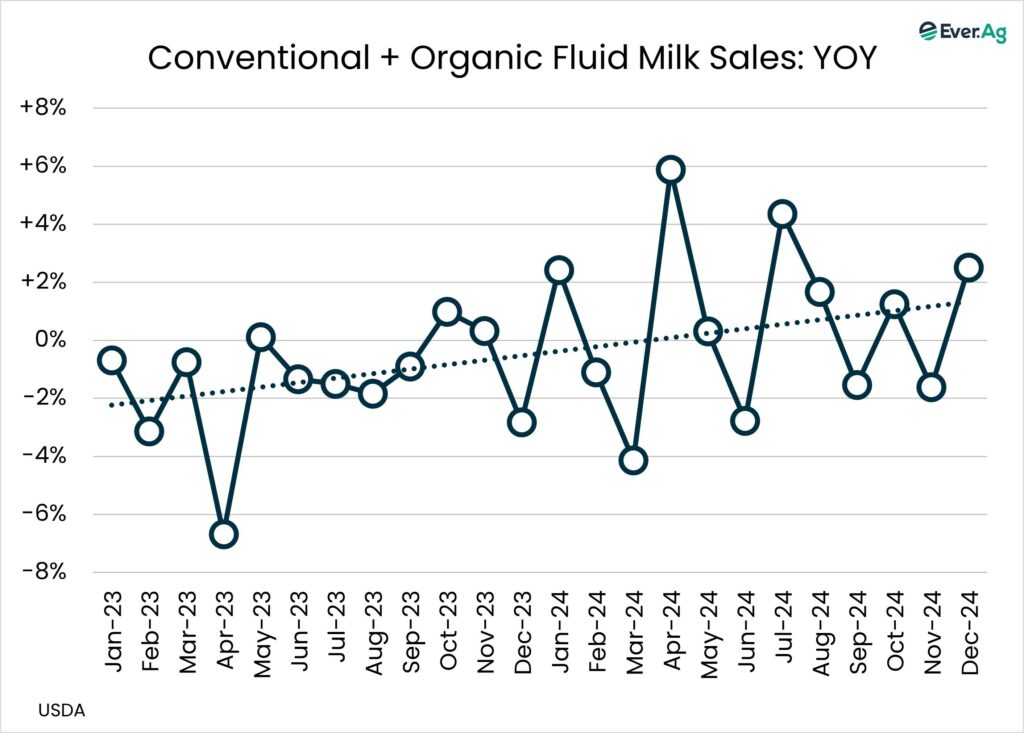

Quick Bites: Fluid Milk's Turnaround

- Falling fluid milk sales was the story for more than a decade, but 2024 reversed that trend. The year finished strong, with December sales of conventional and organic beverage milk up 2.5% year-over-year. In total, annual sales rose to 42.4 billion pounds, up 0.6% from 2023.This was the first year-over-year gain in fluid milk sales since 2010.

- In the conventional milk category, whole milk sales were 2% higher in 2024, and flavored whole milk sales stayed steady. Meanwhile, lower fat varieties dipped in sales.

- A big winner for the year was organic milk, with annual fluid sales up 7.2% from 2023. Whole, flavored whole, and 2% organic milk all bested year-prior levels. In addition, lactose-free and high-protein milk options have also been on a growth trajectory.

- On the flip side, reports indicate that milk alternatives – think soy, oat, and almond beverages – were down on the year. This could be a sign that more people are returning to “real” dairy-based milk.

- While consumption grew last year, the category has a long climb to full recovery. Americans were drinking 247 pounds of fluid milk per person in 1975, when USDA began its data collection. By 2023, that volume had fallen to 128 pounds per person.

Today's Special

- Daily milk production in the U.S. eked out a small gain of just 0.1% in 2024. With highly pathogenic avian influenza infecting more than 700 herds in California, production in the Golden State dragged down overall U.S. milk output. The worst for California dairy herds seems to be in the rearview mirror, though, with reports that production is recovering.

- Even with the challenge of avian influenza, California remained the nation’s top milk state, with more than 40 billion pounds of milk produced in 2024. Wisconsin stayed in second place, with output totaling more than 32 billion pounds. Texas and Idaho were neck and neck for production at just over 17 billion pounds each, finishing in third and fourth place, respectively. Rounding out the top five was New York, with 16 billion pounds of milk produced in 2024.

- Texas saw the most output growth, adding 472 million pounds of production year-over-year. South Dakota followed in second, with 462 million pounds of new milk. Those two states also added the most cows. South Dakota’s dairy herd grew by 18,000 head, while Texas added 15,000 cows in 2024.

- Across the country, cow numbers fell 42,000 head, while milk production was down 0.2%. Farm numbers declined to 24,810 licensed dairy operations, 1,480 fewer dairies than in 2023.

- Milk production will likely grow in 2025, but one big factor will likely stifle major expansion: heifers, or a lack thereof. USDA’s annual Cattle report revealed a January 1 heifer inventory at 3.91 million head, down 40,000 head from a year earlier. The ratio of replacements to milking cows came in at 41.9%, its lowest level since 1991. Heifers are reportedly hard to find, and the ones that make their way to sales barns are expensive. This stands as a hurdle to aggressive growth in milk production.