Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: U.S. Dollar Weakens; Consumer Food Purchasing Changes; and the Job Market in a Minute!

Quick Bites: Changes in Food Buying Habits

- Inflation continues to put pressure on American consumers — particularly those in the lower and middle classes. Although the most recent Consumer Price Index was slightly below expectations, it still increased 0.2% from January to February and advanced 2.8% year-over-year.

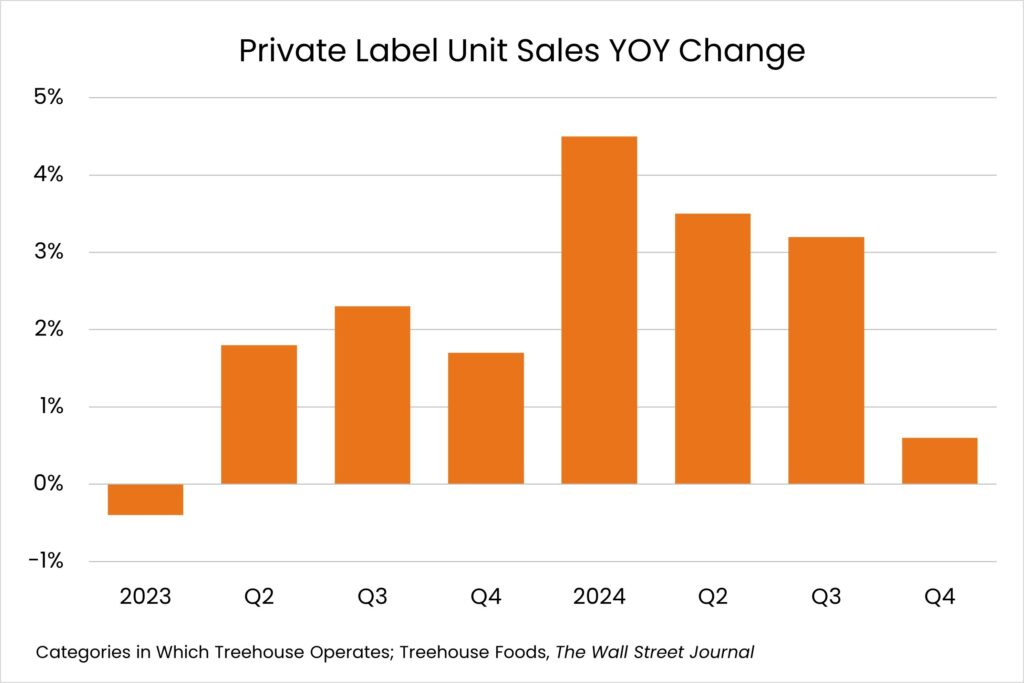

- This pressure shows up in buying habits. TreeHouse Foods, a company that manufactures many private label goods for grocery stores, noted a continued trend of consumers purchasing more store brands over name brand goods.

- But more recently, the company shared that private label sales growth slowed as 2024 progressed. In an article in The Wall Street Journal, the company explained that customers are not only buying fewer brand name foods; they appear to be buying less food overall. With the rising costs of eggs and other essential items, consumers are choosing to leave snacks and other unnecessary goods out of the shopping cart.

- These purchasing habits reflect current consumer confidence levels. The preliminary March reading of the University of Michigan Consumer Sentiment Survey landed at 57.9, down from 64.7 in March and its lowest point since November 2022.

- Is there a turnaround in sight? Not according to TreeHouse Foods. “We don’t have any strong indicators that consumers are going to be less stressed in the near term,” said Patrick O’Donnell, the company’s finance chief.

Today's Special

- The U.S. dollar continues to weaken. Last week, the U.S. Dollar Index closed at 103.68, down another 0.1%, bringing month-to-date losses to 3.10%. Meanwhile, the euro-to-U.S. dollar finished at 1.0884, up 0.30% on the week and up 2.78% on the month. Back-and-forth talk about trade policy and other economic concerns are all weighing on the current value of the dollar.

- Often, weakness is seen as a negative, but in terms of dairy trade, a softer dollar isn’t necessarily bad. When the dollar is weak compared to other currencies, U.S. goods are more appealing on the global market.

- Take butter, for instance. The first week of March, butter closed at $2.30 per pound or €4678 per metric ton at the EUR/USD exchange rate. The last week of February, the same butter would have cost €207 per metric ton more (€4885) at $2.30 per pound.

- Price isn’t the only consideration on the world market. In terms of butter, some customers have specific qualities they are looking for, and American butter isn’t always a fit because of its fat content or coloring. However, a weaker dollar could help overcome some such reservations when it comes to selling products on the export market.

- The elephant in the room is tariffs. Will they happen, or won’t they? Potential tariffs against Mexico and Canada – our neighbors and biggest trade partners – stand to impact dairy products. Right now, cheese might be most vulnerable if it becomes subject to retaliatory tariffs by Mexico, as was the case for a time in 2018. Nearly 40% of U.S. cheese exports went to Mexico last year, worth $2.47 billion.