Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Dairy Heifer Numbers; Strong Frozen Pizza Sales; and Easter Spending in a Minute!

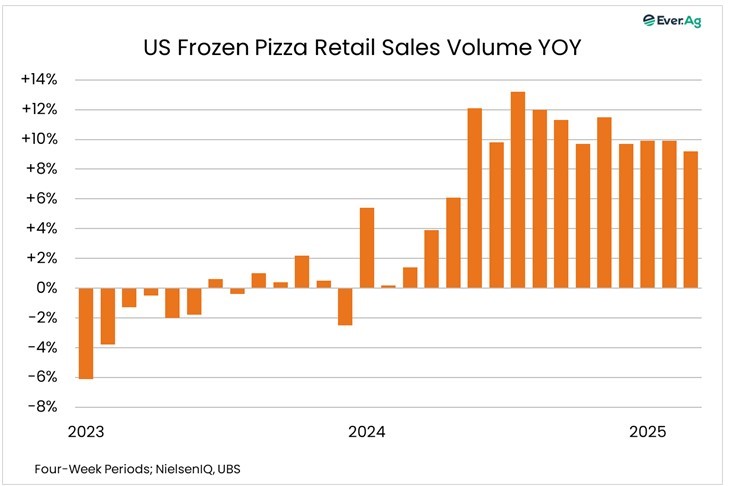

Quick Bites: Frozen Pizza Sales Stay Strong

- Consumer sentiment is low amid economic uncertainty and looming tariffs. More people are choosing to save dollars and eat at home rather than catch a bite at a restaurant. According to placer.ai, during the week of March 31, restaurant traffic was down 3.0% year-over-year while grocery store traffic rose 1.0%.

- Food service is a friend to dairy, as meals at restaurants tend to contain more cheese and other dairy products than those made at home. This is especially true for one of the Americans’ most favorite meals: pizza.

- In a tough economic environment, frozen pizza is holding its ground and then some, with sales up 9.2% year-over-year in the third period (weeks 8-12) of 2025 according to data from AC Nielsen and UBS. Last year, U.S. frozen pizza sales reached approximately $7 billion.

- Do frozen pizzas feature as much cheese as the restaurant variety? Not typically. But a pizza of any kind is still a vehicle for cheese consumption, and frozen pizzas are performing well in 2025 so far.

Today's Special

- Dairy heifer supplies are still tight. USDA’s annual Cattle report, published in late January, confirmed what the industry was already talking about: animal supplies are tight. The report showed a headcount of 3.914 million dairy heifers 500 pounds or larger, the smallest dairy heifer herd since 1978.

- A record small beef cattle herd is one reason why. The U.S. beef herd is at its lowest level in more than six decades. With a shortfall of beef cattle heading to slaughter, demand for dairy beef has been strong. Premium beef prices also drove the beef-on-dairy breeding trend with dairy producers breeding their dairy animals to beef sires to create more valuable calves.

- The price incentive to breed to beef persists. Even with a limited heifer herd and prices climbing to $4,000 a head, dairies in general do not seem to be returning to their old ways of producing excess heifer calves. They appear willing to take $900 for day-old beef calves while hanging on to older cows.

- The U.S. dairy herd reached 9.41 million head in February. That was 15,000 head more than January and up 62,000 compared to last February. At the same time, dairy cow slaughter was down 11% on an average daily basis in February, the lowest level for the month since 2008.

- With maturity comes more milk but also more potential problems. Older cows tend to be more productive than younger herd mates, but they can also have higher somatic cell counts and more health issues. In addition, younger animals typically represent the highest genetic potential in the herd. With a lack of heifers, dairies may need old cows to keep the barn full. However, at some point eroding profit margins and record-high beef prices could reverse this trend and send more cows to market despite the replacement shortage.