Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Diesel Prices Slip, U.S. Dairy Herd on the Decline, and U.S. Dairy Trade in a Minute!

Quick Bites: Dairy Herd Tightens

- Dairy farm margins are tightening as milk prices slide and feed costs remain elevated, and the impact is already being seen in the size of the U.S. dairy herd, which declined by 8,000 head per month in November and December.

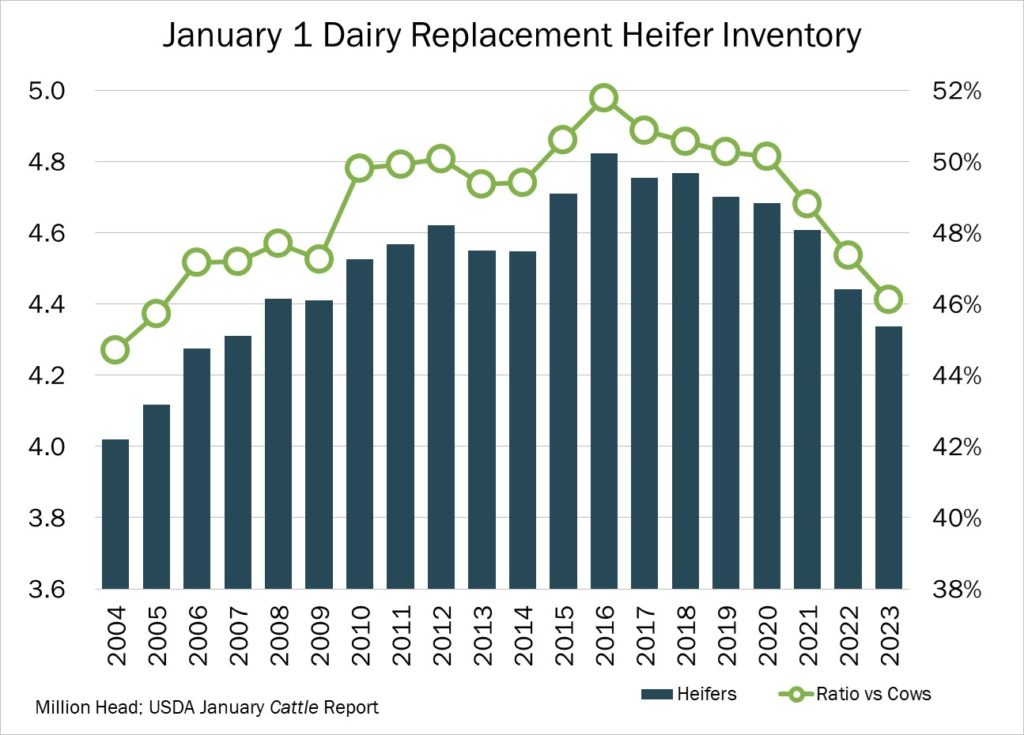

- In addition, data from USDA’s semi-annual Cattle report indicates fewer replacement animals available, making for a longer road to significant herd and milk growth in the months ahead Dairy replacements dropped to numbers last seen in 2007, with a total of 4.3 million head. At the same time, heifers expected to calve 2.8 million cows, 2.0% lower versus 2022. That brought the ratio of heifers to cows to 46.1%, the lowest since 2005.

- What’s causing the contraction? First, margins are tightening, encouraging producers to cull their herds and reduce spending. Raising heifers is expensive, so producers are adjusting their replacement pipeline to deliver the right number of animals years in the future. Also, advancements in genomic technology are making it easier for producers to select breeding cows based on their potential. Cows that aren’t pegged as good dairy cows are being bred to beef instead, netting a higher return for an angus bull calf, for example.

Today's Special

- Last year saw diesel prices leap to an all-time high of $5.82 per gallon, driven by the war in Ukraine and surging demand for goods. The soaring prices had ripple effects through the economy, raising trucking costs, tightening transportation budgets and contributing to inflation.

- Prices did eventually slip off the highs and, so far in 2023, a relatively mild winter and lackluster demand from China has kept keep overall energy prices largely in check. But there are several factors that could support the diesel market later this year. For starters, meteorologists predict temperatures in some regions to drop in February, which could put more strain on supplies flowing into home heating uses.

- And those supplies are tight, particularly in the East. According to the Energy Information Administration, U.S. distillate stocks, which include diesel, are 28 million barrels below the five-year average. Much of that deficit is along the East Coast, where fuel is simply not available at times. A fire in 2019 destroyed a key refinery in that region, and its loss forced the mid-Atlantic and Northeast to turn to the Gulf Coast and international sources to fill the hole. The federal government is carefully monitoring supply constraints and considering possible solutions.

- Meanwhile, there should be a larger-than-normal amount of refinery maintenance this year. Covid forced many companies to delay repair work in 2020 and 2021. Then, last year, businesses put off maintenance yet again in an effort to protect their profit margins in the turbulent economy.

- As Russia’s invasion of Ukraine reaches its one-year anniversary, geopolitical tensions remain. The EU recently banned most imports of Russian refined fuel products and put a $60-per-barrel price cap in place. Russia responded by announced a 5%, 500,000-barrels-per-day cut to its output. That will likely tighten global supplies further.

- While a run back up to the $5 range is possible, experts doubt we will see prices returning to last year’s dizzying highs.