Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Russia Withdrawal From Grain Deal Spikes Futures; Dairy Cow Slaughter Up; And U.S. Milk Production in a Minute

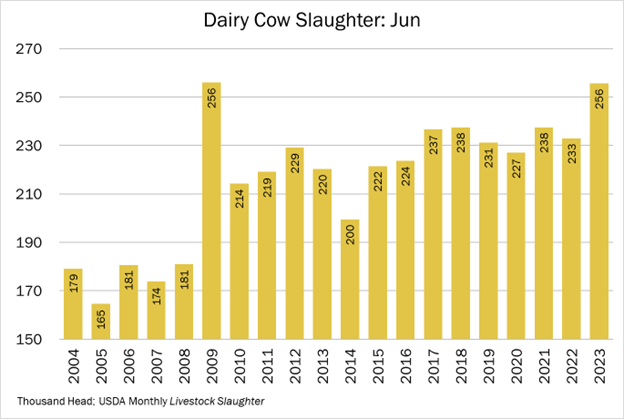

Quick Bites: Slaughter Up, Margins Down

- Dairy cow slaughter rates are spiking amid tight farm margins and higher beef prices. USDA data shows that dairy cow slaughter for the month of June added up to 255,700 head, up 10% year-over-year to the highest level for the month since 2009. Though rates slowed slightly during the week ending July 1, declining 2.3% year-over-year, they remained above the five-year average.

- One culprit behind higher rates: dwindling profits. Dairy Margin Coverage estimates by Ever.Ag Insights peg July margins at the lowest point since 2012. While feed costs are lower this year, milk prices have also declined, pressuring bottom lines.

- At the same time, elevated beef prices are encouraging dairy producers to cut cow numbers. Beef choice cutout – the estimated value of a beef carcass based on prices paid for its individual parts – reached $321.97 per hundredweight during the week ending July 14. That was up nearly $55 versus the second week of July 2022.

Today's Special

- The Black Sea Grain Initiative (BSGI) expired last week as Russia pulled out of the deal. The agreement protected vessels carrying supply from Ukrainian ports and allowed for nearly 33 million metric tons of food exports since its start last year.

- After its departure, Moscow warned all ships entering Ukrainian ports would now be considered military targets. On the heels of the announcement, Russia struck key export infrastructure, including a Ukrainian port on the Danube River. The attacks also hit a grain silo at the Reni port, an action that propelled global wheat futures on the Chicago Board of Trade as high as $7.57 a bushel. The infrastructure damage will affect grain storage and logistics well past any export agreement or conflict solution.

- Under the BSGI, corn represented over 55% of exports coming out of the Black Sea, with wheat accounting for 27% and sunflower oil for 6%. Now, increased demand for U.S. grain could fill the gaps in the global grain trade. However, a strong U.S. dollar may encourage countries to look to Brazil or Argentina for product.

- In addition to grain exports, U.S. producers must now monitor fertilizer supplies and costs. An explosion in June compromised the world’s largest ammonia pipeline, which ran between Russia and Ukraine and was controlled via Black Sea ports. Damage to the pipeline and Russia’s fertilizer exports increases volatility of fertilizer costs for U.S. farmers, adding more uncertainty as supplies are already depleted.