Read the latest issue of The Dairy Bar, a bi-weekly report from IDFA partner Ever.Ag. The Dairy Bar features spotlight data, key policy updates, and a one-minute video that covers timely topics for the dairy industry.

The Dairy Bar: Personal Savings on the Decline; U.S. Dollar Strength on the Incline; and U.S. Trade in a Minute!

Quick Bites: Rising Dollar

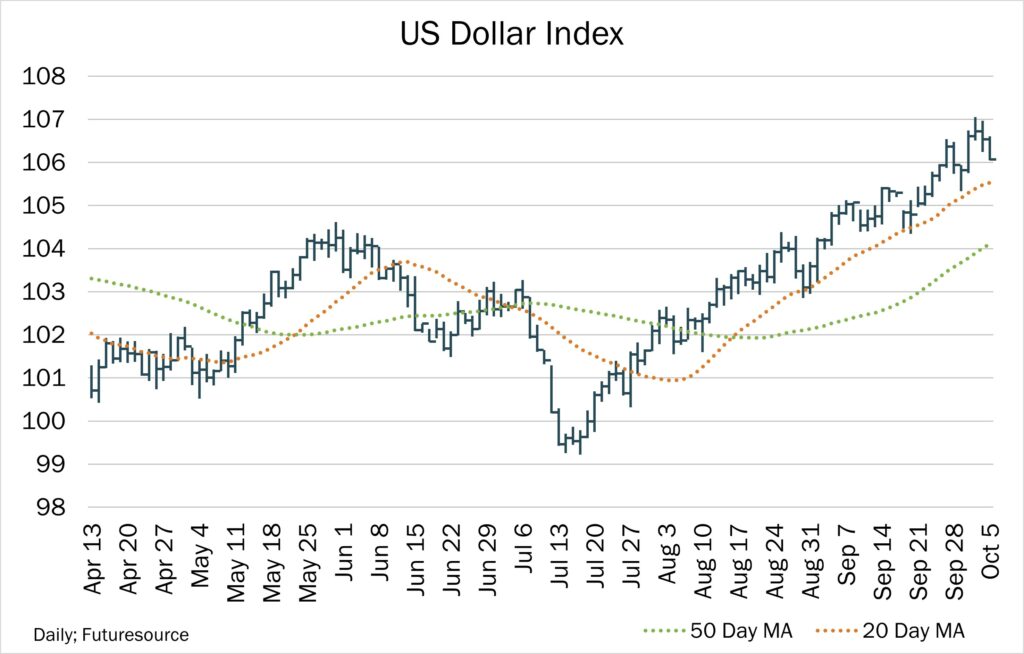

- After a sluggish start to 2023, ongoing (and unexpected) economic strength as well as prospects for higher interest rates have given the greenback new life. The week ending October 6 marked the twelfth consecutive week of gains for the U.S. Dollar Index – the longest streak since October 2014. Earlier this month, the real yield on U.S. 10-year treasuries reached 2.47%, the highest in almost 15 years.

- So far this fall, the USDX, which compares the dollar to six foreign currencies, has climbed as high as 107.05, the highest level since November 2022. But with the weak start to the year and 2022’s record strength, the index is still 5.7% below prior-year levels.

- Meanwhile, the strong dollar likely continues to impact dairy product exports. U.S. prices for some commodities are already uncompetitive on the global market. But the powerful greenback makes U.S. products even more expensive relative to, say, dairy items from Europe.

- Analysts expect the current winning streak to continue for the time being, but once the Federal Reserve stops raising interest rates and if a long-expected U.S. recession begins, the dollar could soften again.

Today's Special

- While a recent uptick in American wages is providing some relief to consumers, many are still struggling to save. The U.S. Bureau of Economic Analysis reported August personal income at $23.1 trillion, a 5.0% increase versus 2022 levels. Data from the St. Louis Federal Reserve shows personal savings still account for only 4.1% of disposable income. When asked what factors prevented them from putting more in the bank, 34% of consumers claimed inflation and higher costs of living as the top culprits.

- As a response, more shoppers are turning to installment plans to cover their bills. Per data from the Federal Reserve, one in eight consumers have reported using a buy now, pay later (BNPL) service in the past 12 months. Financial flexibility is the main driver behind the trend, with 74% of users claiming the plans help them better manage their spending. Meanwhile, 30% of consumers rely on the services to strengthen their credit score.

- And while installments are typically associated with larger purchases such as electronics and furniture, consumers are also leveraging the payment plans to buy everyday goods. Data from PYMNTS Intelligence suggests over 39% of shoppers paid for clothing and accessory items through installments in the last year, and 34% paid for groceries.

- Data also shows Americans across all income brackets are seeking the budget-friendly payment options. In fact, 64% of shoppers earning over $100,000 utilized installment plans. That compares to 61% of middle-income shoppers and 54% of lower-income consumers.