Quick Bites: Delivery Woes

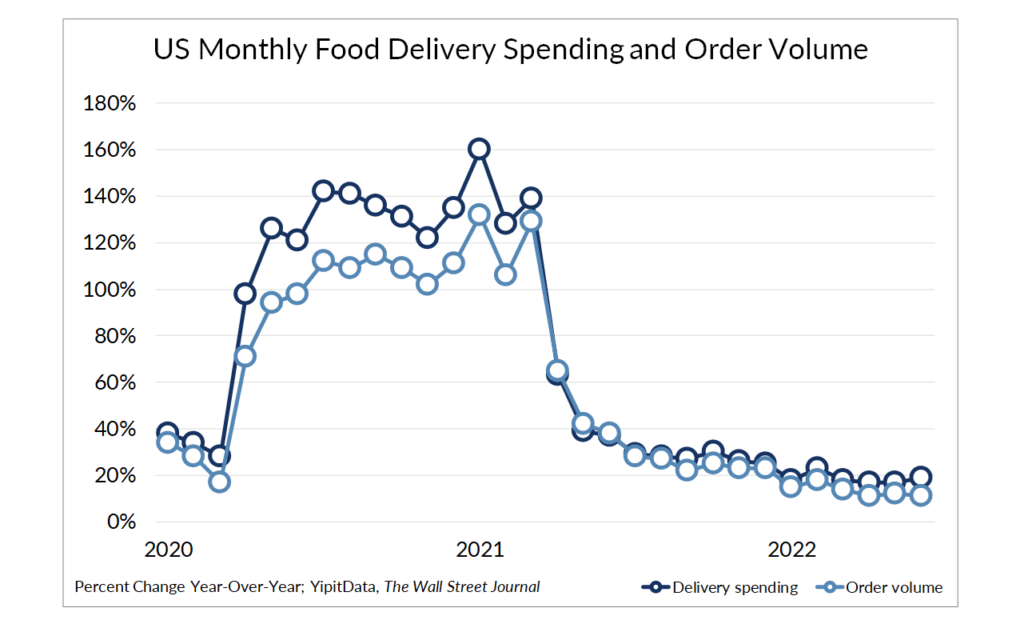

- Elevated prices and recessionary fears are not only impacting consumers, but the companies that feed them, too. During the second quarter of 2022, the total number of orders placed with food delivery companies like DoorDash and Uber Eats rose 11% over prior-year levels, the slowest quarterly expansion since the beginning of the pandemic. By comparison, orders rose 48% during the same period in 2021 and +88% during Q2 2020.

- In response, third-party delivery apps are rolling out new deals to entice customers who are cutting back on discretionary spending. Uber and DoorDash are focusing on grocery and alcohol delivery, which cut down on labor costs because multiple orders can be fulfilled and delivered at the same time. The companies are also encouraging users to subscribe to their services and pay monthly fees for delivery discounts. And Grubhub announced last month that it will offer free delivery to Amazon Prime members.

- But deals and discounts may not be enough to earn consumer dollars, leading delivery companies to take additional measures. DoorDash announced plans to increase the minimum order size for free delivery on smaller household items. Uber said in May it would slow hiring. And apps are working to limit delivery fees from the restaurants they serve.

Today's Special

- Retail inventories are mounting as inflationary worries cut into consumer spending. The U.S. Department of Commerce and Federal Reserve of St. Louis reported the inventory-to-sales ratio at general merchandise stores reached 1.58 in May, the highest level since September 2007. Comparatively, the ratio hit a low of 1.16 in March 2021 as retail sales jumped 28.6% year-over-year to $623.1 billion.

- It’s an issue driving up costs for a variety of retailers. Costco Wholesale Corp. reported its inventory levels soared 26% during the fiscal third quarter on heavy stocks of holiday merchandise, small appliances and household items. At Gap Inc., inventories jumped 34% on the back of slower sales and longer transit times.

- Analysts blame ballooning inventories on higher prices and supply chain snarls. Retailers struggled to put product in consumers’ hands last year amid surging demand and tight freight capacity. As a result, many companies ordered excess stock. But as inflation reduces Americans’ spending power, they’re cutting back on shopping trips.

- Stuck with items they don’t want, many retailers are offering deep discounts. Target, which held roughly $15 billion in inventory during the first quarter, announced it expects a drop in profit as it cuts prices. Walmart also said in May it plans to roll out “aggressive” discounts after its stocks rose 33%.